Add and Edit Payroll Distribution Codes

Access this form by clicking on any distribution code in the "Maintain Distribution Codes" table, or click the button at the upper left of the table to enter data into an empty form.

button at the upper left of the table to enter data into an empty form.

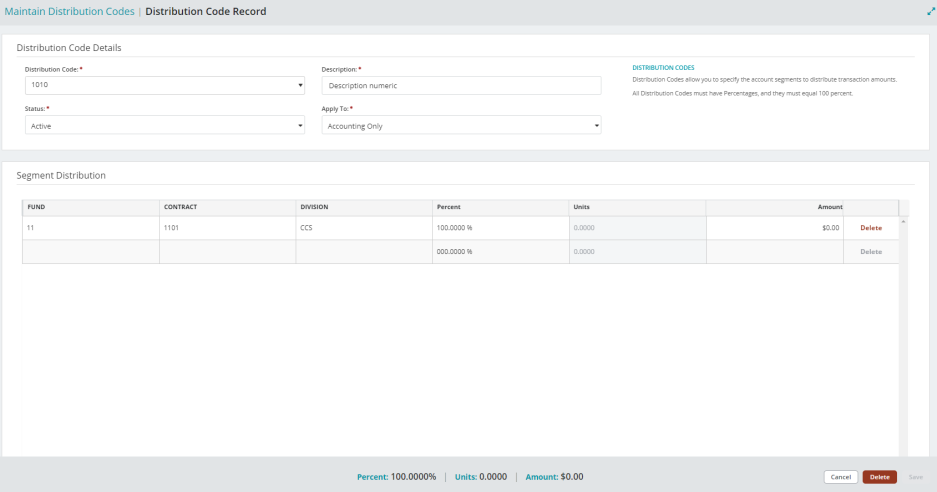

This form is split into two sections: Distribution Code Details, and the Segment Distribution table. At the bottom right of the form are three action buttons: Cancel, Save, and Delete.

Distribution Code Details

| Distribution Code |

Select a previously entered code from the dropdown list, or enter a new Distribution Code that describes the accounting entry template you are creating.

|

| Description | Enter or change the description of the Distribution Code. |

| Status |

Specify the status of the code. The status can be changed at any time. Below are valid status entries and their descriptions:

|

| Apply To | Select whether you want to apply your Distribution Codes to Accounting only (A), both Accounting and Payroll (B), or Payroll only (P). |

Segment Distribution Table

| Segment Codes |

Enter the codes for the account segments displayed.

|

| Percent |

Enter the percent you want distributed to the current line item. You must have at least one line item with a percent and the total percent must equal 100.

|

| Hours |

Enter the fixed amount of labor hours you want distributed to the current line item. The system automatically calculates the resulting percentages; percentages cannot be manually entered on any line. |

| Amount |

Enter the fixed amount you want distributed to the current line item.

|

|

Delete |

Click to remove a Distribution Code Details table entry that has no activity. |

Reset Grid: The Reset Grid button will reset the specific table to its default order. See the Tips and Shortcuts page for more information on reorganizing grids.

When you are finished making your changes, click  .

.

To go back to the Payroll System Setup help page, see System Setup.