Payroll Processing Groups

Use this form to set up new processing groups, which are required for processing payroll. Processing groups are used throughout the system to group several employees together so that the employees can be processed and reported together.

Generally, create only as many processing groups as pay cycles. However, create more than one processing group for a specific pay cycle to separate employees for reasons other than when they are paid.

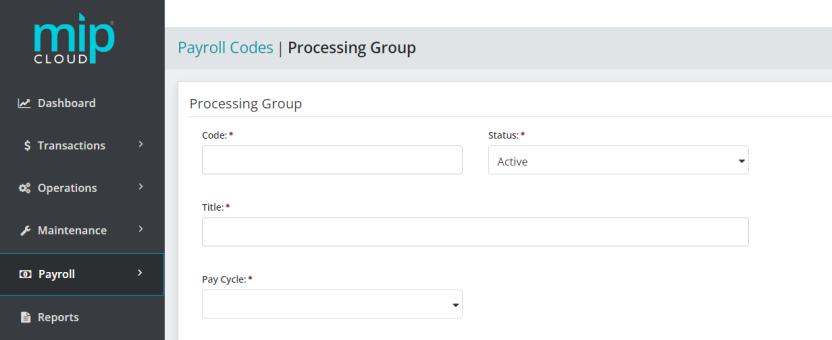

The landing page when adding or editing a processing group.

Follow along with the form below, or click a link to jump to that section:

Processing Group

| Code |

Enter a Processing Group code. You should make the first eight characters of the code unique so that the paycheck displays a useful identifier. We recommend limiting your entry to strictly alphabetic characters (A through Z) or numeric characters (0 through 9), and avoiding the use of symbols. |

| Status |

Specify the status of the code. The status can be changed at any time. Below are valid status entries and their descriptions:

|

| Title | Enter the title of the processing group |

|

Pay Cycle |

Select a pay cycle of W (Weekly), B (Biweekly), S (Semimonthly), or M (Monthly). |

Note: Note that once processing has begun for any pay date for a pay cycle, the pay cycle cannot be changed.

Pay Cycle Schedule

Use this section to specify the pay dates for the processing group.

Use the "First Pay Date" and "First Pay Period End Date" boxes to have the system automatically schedule pay periods and dates based on the pay cycle that was entered in the section above. You can then change the information in the Pay Dates table as appropriate.

If you enter a new First Pay Date, the system overwrites the previously entered dates.

| Year |

Enter the tax year for which you want to enter pay dates. |

| First Pay Date | Enter the date for the first payroll of the year. The system uses this information to complete the Pay Dates table. |

| First Pay Period End Date |

Enter the Pay Period End Date for the first Pay Period of the year. The system uses this information to complete the Pay Dates table. |

|

Pay Dates |

If you are reviewing an existing processing group, the Pay Dates previously entered are displayed.

|

Be sure to enter a valid pay date so that when you calculate payroll, the processing group is available for selection.

Note: Once a timesheet has been entered for a pay date, you have begun processing a payroll for that date.

When you are finished making your changes, click  .

.