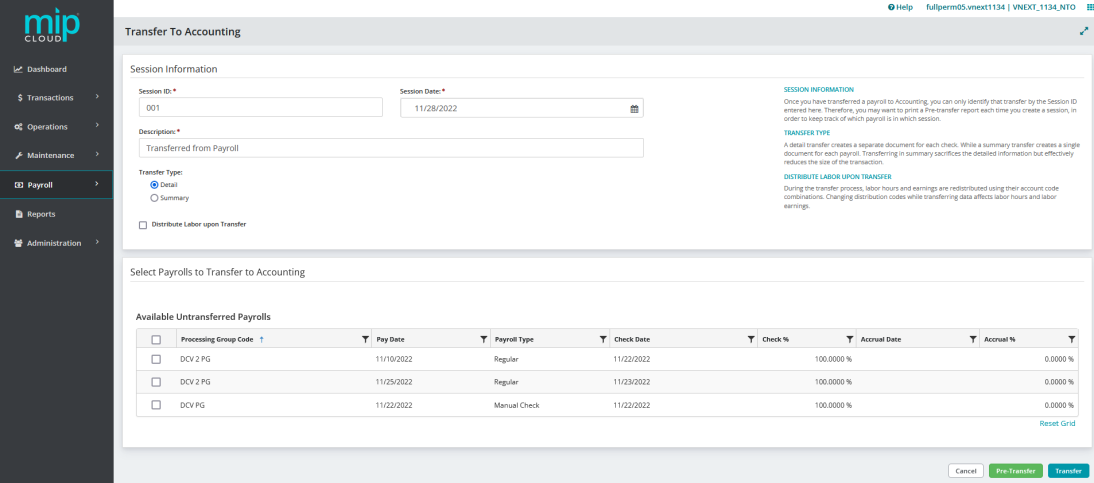

Transfer to Accounting

Use this form to transfer payroll data to Accounting.

Note: Entries created by this process are not posted. To post these entries, you must go to Payroll>Sessions>Manage Payroll Sessions.

This form is split into two sections: Session Information, and Select Payrolls to Transfer to Accounting.

Session Information

Session ID: Enter a session ID for the transferred entries.

Session Date: Enter the date for this transfer session.

Description: Enter a description for this session. The default description is "Transferred from Payroll."

Transfer Type: Select a transfer type of either "Summary" or "Detail".

A detail transfer creates a separate document for each check.

A summary transfer creates a single document for each payroll. Transferring in summary removes the detailed information but effectively reduces the size of the transaction.

Document ID: If "Summary" is selected, enter a unique document number or accept the number that the system assigned. When generating a "Summary" type Payroll Transfer, the system displays the next available number.

Distribute Labor upon Transfer: Select this checkbox to update the distribution of labor hours and labor earnings when changes to Payroll Earning Codes (using the Track Labor Hours checkbox) and/or Payroll Distribution Codes (changing percentage distribution) occur after the payroll checks/vouchers were printed and prior to the transfer of the payroll to Accounting. Selecting this checkbox deletes the existing labor hours/earnings distribution and replaces it with the new percentage distribution and/or applicability of "Track Labor Hours."

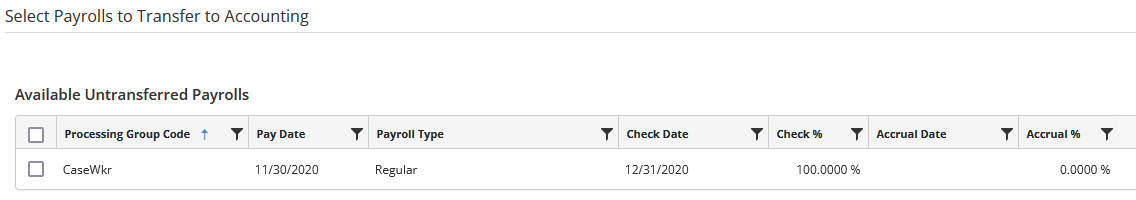

Select Payrolls to Transfer to Accounting

The table contains only payrolls for which you have printed, voided, or manually entered checks/vouchers. Furthermore, you can only transfer payrolls that have not yet been transferred. The table displays a processing group code, its Pay Date, Payroll Type (Regular, Void, Manual, or Supplemental), and Check Date.

You can also enter a Check Percent, Accrual Date, and Accrual Percent in this table. The check and accrual percentage must equal 100% when combined, and the accrual date must be prior to the check date. Accrual entries are only created if the Check % does not equal 100%. For more information, see Accruals.

Notes about Transferring Payrolls to Accounting

If you choose to enter accrual information in the untransferred payroll tables, the end result could be skewed by a few cents because numbers must be rounded when calculating amounts by certain percentages.

In order for the system to calculate accruals, a check and accrual percentage (other than zero) must be entered in the table.

Even if the system preferences are set to Online Posting, transferred entries are designated as Batch-To Post. To post these entries, you must go to Payroll>Sessions>Manage Payroll Sessions.

To transfer accounting data for benefits when no earnings are entered on the timesheet, go to Payroll>System Setup>Payroll Codes>Benefit Codes, select "Follow Earnings on Timesheet" in the "Benefit Distribution" section of the benefit code form, and enter a distribution code in the "Distribution Code to Use if no Earnings Exist" field. See Transfer to Accounting for more information.

During the transfer process, labor hours and earnings are redistributed using their account code combinations. So, changing distribution codes while transferring data, affects labor hours and labor earnings. To track labor hours and labor earnings by account code combinations, set up Payroll Earning Codes with the "Track Labor Hours" checkbox selected.

If you want to process employee reimbursement and advances through regular payroll processing (by applying the net pay amount without the amount being subject to taxes and fringe benefits), create an Earning Code with the "Contribute to Net Pay Only" checkbox selected (see Payroll Earning Codes).

Note: For information on accruals, see Accruals.