Payroll Workers' Compensation Codes

Use this form to add a new Workers' Compensation Code or edit an existing one. The system uses Workers' Compensation codes when it is calculating pay, creating an accounting entry for payroll, calculating and reporting W-2 information and other tax reports, and reporting.

You must assign a General Ledger expense and liability account in order to create an accounting entry. Use the "Workers' Compensation Distribution" section of the form to determine the distribution of the benefit expense across all other segments.

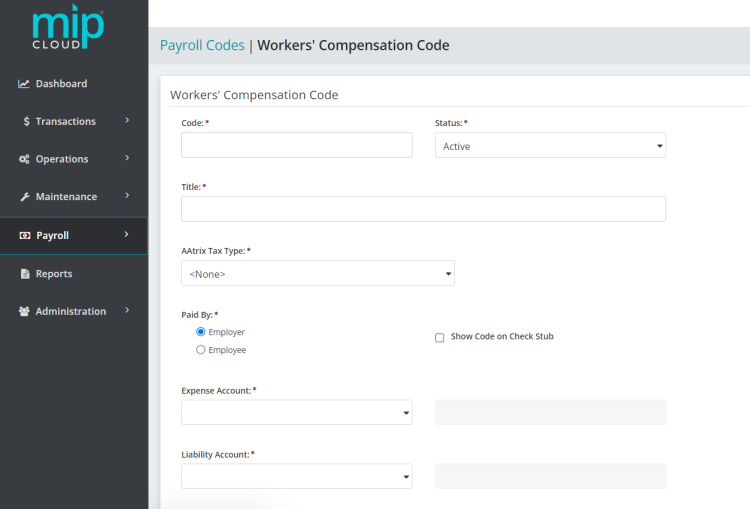

The landing page when adding or editing a workers' compensation code.

Click a dropdown link below to learn more about the fields in each section of the form.

| Code |

Enter a Workers' Compensation Code. You should make the first eight characters of the code unique so that the paycheck displays a useful identifier. We recommend limiting your entry to strictly alphabetic characters (A through Z) or numeric characters (0 through 9), and avoiding the use of symbols. |

| Status |

Specify the status of the code. The status can be changed at any time. Below are valid status entries and their descriptions:

|

| Title | Enter the title of the Workers' Compensation Code. |

|

Aatrix Tax Type |

Accept the default of <None>, or select a state to be associated with this Workers’ Compensation code for Aatrix payroll reporting. |

|

Paid By |

Select which party is paying the workers' compensation amount for this code—the employer or the employee. |

|

Show Code on Check Stub |

If the Employer is paying the workers' compensation, select this checkbox to display the Employer Workers' Compensation Code information below the Employee Workers' Compensation Code information on the check stub. If you select this option, the following applies when the employee's check is printed:

|

| Expense Account |

Enter the General Ledger expense account for this Workers' Compensation Code. The account must be an existing General Ledger account that is not a subledger-type account. The account must have a status of Active or Inactive.

|

|

Liability Account |

Enter the General Ledger liability account for this Workers' Compensation Code. The account must be an existing General Ledger account that is not a subledger-type account. The account must have a status of Active or Inactive. |

Note: If both the employer and employee pay workers' compensation, set up two different codes and apply each to the employee's timesheet.

Choose a calculation method for this code. The available methods are:

Rate per Hours Worked: Select this method to have the system take the hours associated with all the earning codes (specified in the Earnings to Use for Selected Calculation section), and multiply them by the rate specified in the "Rate" field of this section. The result is then multiplied by the Adjustment Factor, if one is supplied.

Rate per Workers' Compensation Hours: Select this method to provide a Rate which is then multiplied by the hours you specify later, on the timesheet, for workers' compensation hours. This result is then multiplied by the "Adjustment Factor", if one is supplied. There are no Earning Codes associated with this method.

Rate per $100 Earnings: Select this method to have the system take all earnings on the timesheet (for the Earning Codes specified in the Earnings to Use for Selected Calculation section), and add in the year-to-date subject earnings. This sum is then compared to the "Maximum Subject Earnings" in this section.

Note: When using the "Rate per $100 Earnings" calculation method, if the "Maximum Subject Earnings" amount is greater than that sum, then the current period subject earnings are used to calculate the workers' compensation amount. If the "Maximum Subject Earnings" amount is less than that sum, then the amount used to calculate workers' compensation is the "Maximum Subject Earnings" less the year-to-date earnings. The resulting amount is then divided by 100 to get the rate per $100 earnings. The system uses this number to multiply by the "Rate" and "Adjustment Factor".

Choose a calculation method, then fill out the following fields as required by the calculation method:

| Rate |

Enter the rate for this code. |

| Adjustment Factor |

Enter the adjustment factor for this code. |

| Maximum Subject Earnings |

Enter the maximum subject wages allowed in calculating workers' compensation. This field is only available if you selected the "Rate per $100 Earnings" calculation method. |

Note: This section is only available if you selected the "Rate per Hours Worked" or "Rate per $100 Earnings" calculation methods.

Select the Earning Codes to use when calculating workers' compensation.

Any Earning Code set up with "Contribute to Net Pay Only" (see Payroll Earning Codes) is not available to use when calculating this benefit.

Use this section to specify how to distribute the workers' compensation expense (if employer paid). Note that this section is only available if "Paid By Employer" was selected in the first section of this form.

| Follow Earnings on Timesheet |

Select to have workers' compensation amounts distributed the same way the employee's earnings are distributed.

|

|

Follow Earnings Used to Calculate the Workers' Compensation |

Select to limit distribution to the earnings used to calculate the workers' compensation (from the Earning Codes specified in Earnings to Use for Selected Calculation).

|

|

Use Distribution Code |

Select an existing distribution code to distribute the workers' compensation, which may be entirely or partially distributed to overhead.

|

When you are finished making your changes, click  .

.