Deferred Membership Scenario: Semiannually by Calendar

Defer a Membership add revenue when you want to delay recognizing the revenue from the dues. For example, a member pays her dues in April, but you don't want to recognize half of the revenue until the middle of your association's calendar year in June and then the final half at the end of your association's calendar year in December.

This scenario takes you through deferring a membership and recognizing the revenue twice in your association's calendar year.

Deferring a Membership SemiAnnually

To start this process, you must have accomplished the following in netFORUM first:

Add your Association.

Add a Business Unit for your Association.

Create G/L Accounts for the Business Unit. The G/L account types must include Deferred and Liability.

Add a Member Type with Calendar Dues. Go to Modules > Membership> Overview > Member Type. On the Add - Member Type page, under the Membership Dues Information, fill in the fields in the Calendar Dues Section.

Set up Membership drop-down list values. Membership > Overview

Set up Membership System Options.

Add an Association Dues Package using the following steps:

- Go to Modules > Membership > Associations > Find, List, or Query Associations > Association Profile > Dues Tab > Membership Packages child form.

- Click the Add

button. The Add - Association Dues Package page opens.

button. The Add - Association Dues Package page opens. - Fill in all the required fields for the Add - Association Dues Package page. See the Adding an Association Dues Package topic for instructions.

- Click the deferred check box. Two other fields appear: an unlabeled field (where you can select your deferred account), and a revenue recog frequency field.

- For the unlabeled field, click the down arrow and select the account, (Deferred or Liability) that will receive the revenue once it is recognized.

- In the revenue recog frequency field, select Semiannually.

- Click the Save button.

Here's What Happens to Your Numbers

On sale of the membership, GL records are created. Close the batch to do the following:

- create the deferral record.

- start the deferral schedule based on your selection in the revenue recog frequency field.

netFORUM recognizes half of the revenue from the sold membership 364 days from the first day of the month in which the batch is closed. netFORUM puts that revenue in the Deferred or Liability account that you chose in step 5 above.

Note: When you close a batch, netFORUM creates ledger entries (deferral or revenue). When you close a period, netFORUM recognizes deferred revenue for the recognize revenue after dates contained in that period.

Scenario:

This scenario takes you through deferring a membership and recognizing the revenue in two, semiannual increments ending on the association's calendar year, where the membership is not prorated.

Your fiscal year: January - December

Your "sell for next year after month" is: June

Your "sell for next year after day" is: 1

Yearly membership purchased on: April 10, 2015

Full membership price paid: $120.00

Batch closed on: April 15, 2015

Deferral Start Date = January 1, 2015 (show $60 per six months until Deferral End Date)

Deferral End Date = December 31, 2015

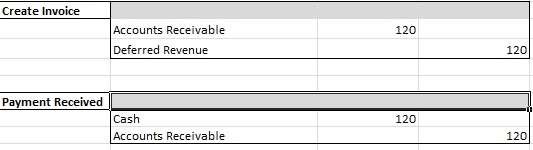

Invoice Created and Payment Received

| Deferral | Revenue | ||

|---|---|---|---|

| $60.00 | $60.00 | ||

| $60.00 | |||