Indirect Cost Rate Example

In methods other than Indirect Cost Rate, if the Pool is made up of various segments combined with debit balance GL accounts, such as expenses type, then the final direction of the allocation entry is made up of credits to the Pool lines and debits to the recipient lines. The opposite would be true if the Pool was made up of credit balance GL accounts, such as revenues. In an Indirect Cost Rate allocation, the final direction of the entry ignores the sign (debit or credit) of the Pool GL accounts and allocates strictly based on the sign of the GL accounts used to calculate the indirect cost rate. Therefore, if the GL accounts used to calculate indirect cost rate are carrying a credit balance, the final entry will be made up of credits to the recipients and debits to the pool accounts. The opposite would be true if the indirect cost rate was carrying a debit balance. This would be true regardless of the natural balance of the GL accounts used in the pool.

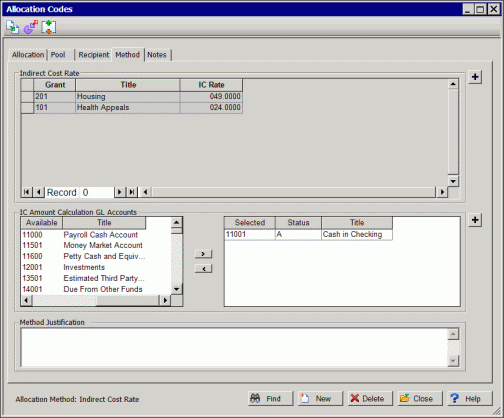

The following example displays the Method tab with the Indirect Cost Rate allocation method chosen on the Allocation tab.