Applying Tax Exemptions in the Online Store

Canadian users of netFORUM Pro require the ability to be able to track taxes on all of their products. These products include events, memberships, and all other products that are sold. Note, this system option must be enabled by support or an account manager.

In addition to the requirement to be able to track all taxes, Canada has specific tax rules for types of products being sold. These guidelines are as follows:

If a member/customer works for the government and should not be taxed, the current tax exempt functionality should be used. For more information on applying tax exemptions, visit the Applying Tax Exemptions online help topic.

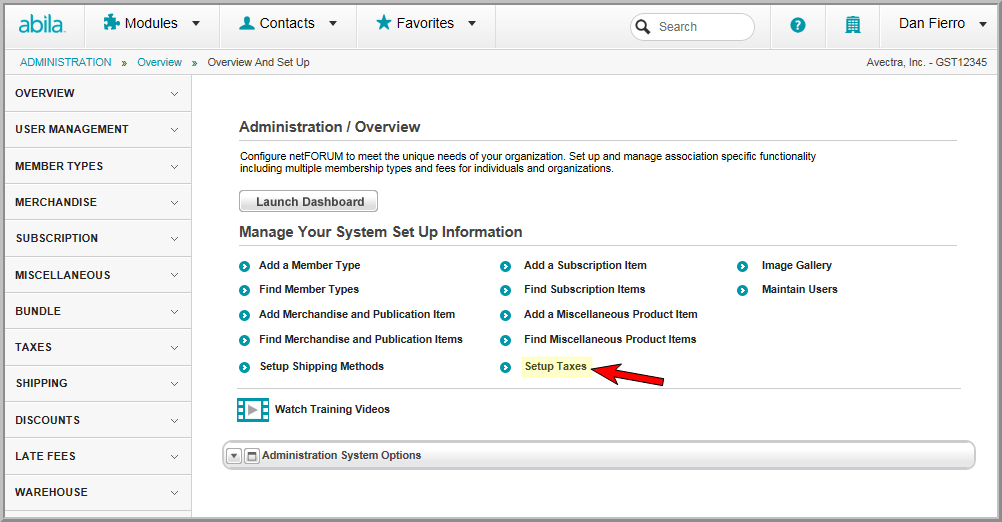

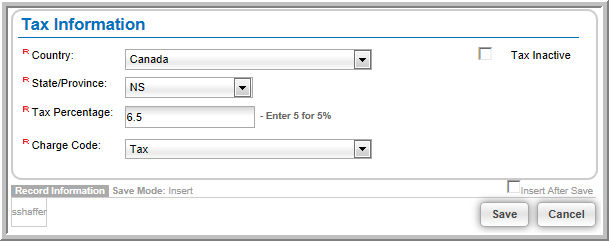

Before the VAT tax calculations can be applied, the various tax rates for Canada’s provinces must be set up.

Note: You must have the EnableVATTax system option enabled to use this feature.

To set up the taxes for the individual provinces in Canada, complete the following steps:

Once the VAT tax is setup and the system option is enabled, the VAT tax will be available for calculation during the checkout procedure when purchasing event registrations, memberships, certifications, and other netFORUM products. However, each of those products must be setup to have taxes applied during purchase.