Add Bank Reconciliation

Note: By default, MIP allows you to perform a manual bank reconciliation. If you have your organization linked to a bank account through Mastercard’s open banking platform (Finicity), you can perform an automated bank reconciliation. You can set up a financial institution connection under Administration > Organization Settings > Module Setup > Connect to Financial Institution.

Click a link below for the type of Bank Reconciliation your organization performs:

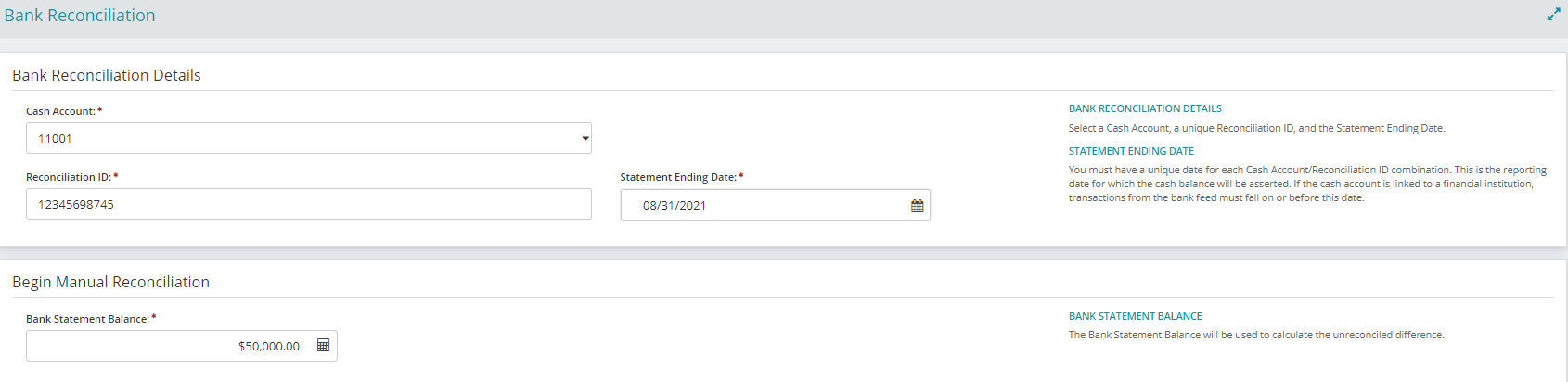

Cash Account: Select a Cash Account from the drop-down menu.

Reconciliation ID: Enter a unique ID for the reconciliation.

Statement Ending Date: Enter the ending date of the statement you wish to reconcile.

Bank Statement Balance: Enter the current statement balance for the selected cash account. This amount is used to calculate the unreconciled difference. This field does not display when using automated bank reconciliations.

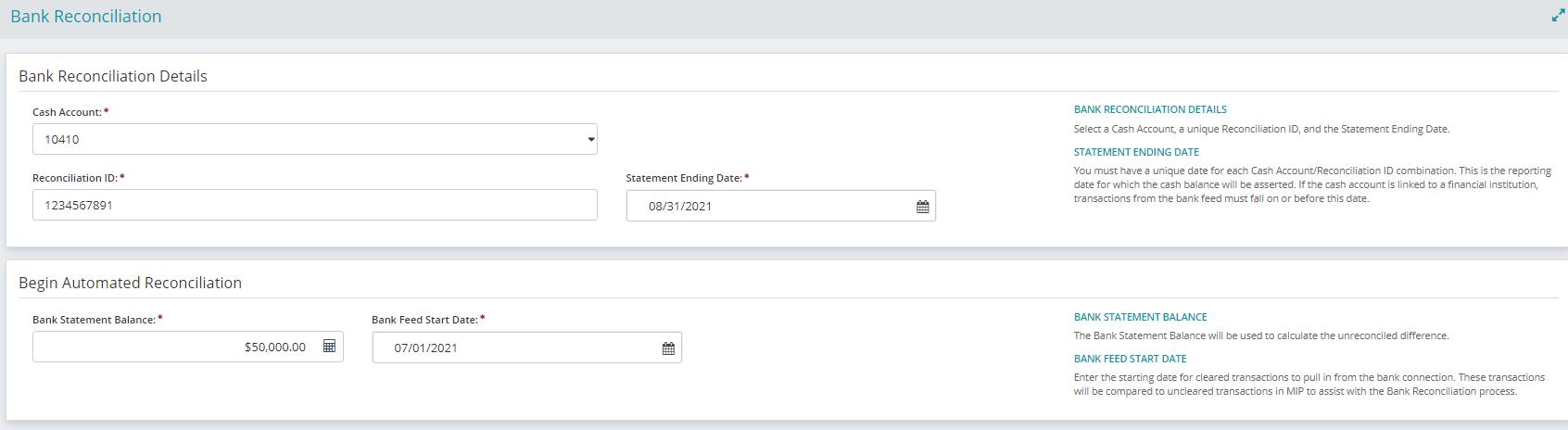

Cash Account: Select a Cash Account from the drop-down menu.

Reconciliation ID: Enter a unique ID for the reconciliation.

Statement Ending Date: Enter the ending date of the statement you wish to reconcile. If the cash account is linked to a financial institution, transactions from the bank feed must fall on or before this date.

Bank Statement Balance: Enter the current statement balance for the selected cash account. This amount is used to calculate the unreconciled difference.

Bank Feed Start Date: Enter the starting date for cleared transactions to pull in from the bank connection. These transactions will be compared to uncleared transactions in MIP to assist with the bank reconciliation process.

Tip: We recommend starting your automatic bank reconciliation 45 days prior to your Statement Ending Date to account for all monthly transactions.