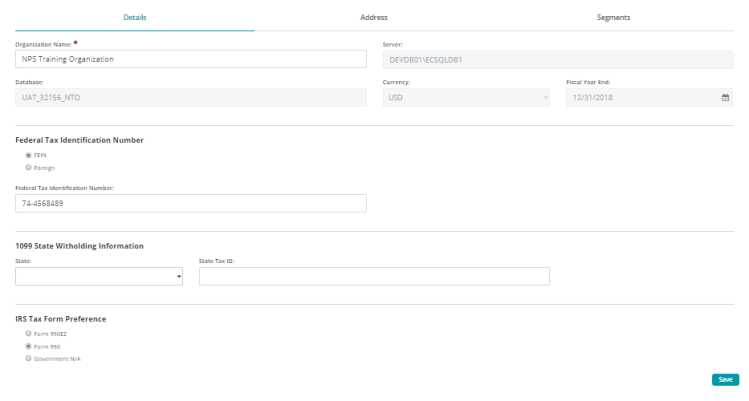

Organization Information Details Tab

This tab is opened by default when the Organization Settings Information form displays and Information is selected on the left. To return to it from any other tab, click Details on the tab bar at the top of the Organization Settings form.

Details

Organization Name: Enter or update your organization's name.

Server: Read-only field listing your organization's server.

Database: Read-only field listing your organization's database.

Currency: Read-only field listing your organization's default currency.

Fiscal Year End: Read-only field listing your organization's Fiscal Year End.

Federal Tax Identification Number

FEIN: The Federal Employer Identification Number. Selected by default.

Foreign: Select this option if your organization uses a foreign tax identification number.

Federal Tax Identification Number: Your organization's federal tax identification number.

1099 State Withholding Information

State: Select your organization's state (or US territory) from the drop-down list.

State Tax ID: Enter your organization's state tax ID.

IRS Tax Form Preference

Form 990EZ: Select this option to enable this form for your organization.

Form 990: Select this option to enable this form for your organization.

Government N/A: Select this option to enable no form for your organization.

Button

Save: Click to save any changes made on the form.