Payroll Benefit Codes

Use this form to add a new Benefit Code or edit an existing one. MIP Cloud uses benefit codes when it is calculating pay, creating an accounting entry for payroll, calculating and reporting W-2 information and other tax reports, and reporting.

You must assign a General Ledger expense and liability account in the "Benefit Code" section, in order to create an accounting entry. Use the "Benefit Distribution" section of the form to determine the distribution of the benefit expense across all other segments.

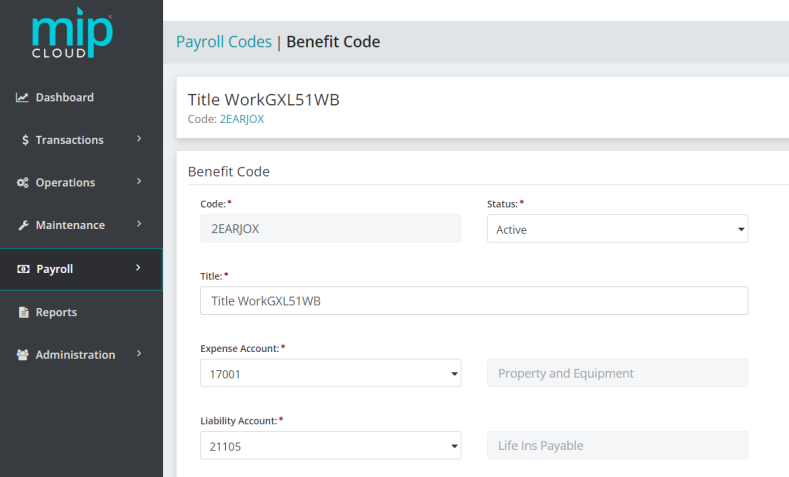

The landing page when adding or editing a benefit code.

Click a dropdown link below to learn more about the fields in each section of the form.

| Code |

Enter a Benefit Code.

|

| Status |

Specify the status of the code. The status can be changed at any time. Below are valid status entries and their descriptions:

|

| Title | Enter the title of the Benefit Code. |

| Expense Account | Enter the General Ledger expense account for this Benefit Code. The account must be an existing General Ledger account that is not a subledger-type account. The account must have a status of Active or Inactive. |

|

Liability Account |

Enter the General Ledger liability account for this Benefit Code. The account must be an existing General Ledger account that is not a subledger-type account. The account must have a status of Active or Inactive. |

|

Show Code on Check Stub |

Select this check box to display the Benefit Code information on the check stub. |

|

W-2 Information Box Number |

Select W-2 Box Number 7, 8, 10, 11, 12, or 14 if this Benefit Code falls into one of those W-2 categories.

|

Note: Earnings are money paid to an employee, which increases net pay. A benefit, on the other hand, is something provided to the employee for which the employer pays a third party (they do not increase net pay). For example, life insurance for an employee that exceeds the federally allowed maximum, and use of a company car for personal reasons, are benefits. These benefits do not increase the employee's net pay, but must be included as taxable income to the employee (and thus they increase taxable earnings and applicable taxes). Use this distinction when determining whether to enter an item as an Earning or a Benefit Code.

Choose a calculation method for this benefit code. The available methods are:

Fixed Percentage of Earnings: Select this method to have an employee accrue benefits based on a percentage of earnings. The system first takes the total earning amount for just those earnings that are tied to the Benefit Code (as indicated on the Earnings tab). This earning amount is then multiplied by the percentage indicated in the Percentage box, to get a fixed percentage of earnings. Note that when using this calculation method, benefits vary with earnings.

Fixed Hourly Amount: Select this method to have the system base benefits on a fixed rate per hour worked. The system multiplies only the earning hours that are tied to the Benefit Code (as indicated on the Earnings tab), by the hourly amount specified in the Amount box. Note that when using this calculation method, benefits vary with hours worked.

Fixed Amount: Select this method when a benefit is based on a fixed amount per pay cycle. Enter a fixed benefit amount (in the Amount box) to calculate payroll.

Amount on Timesheet: Select this method to use the fixed amount, entered on the employee's timesheet, for benefits.

Percentage on Timesheet: Select this method to use a fixed percentage, entered on the employee's timesheet, for benefits.

Choose a calculation method, then fill out the following fields as required by the calculation method:

| Percentage |

Enter a percentage or amount, depending on the calculation method selected. You should enter a percentage for Fixed Percentage of Earnings, or an amount for Fixed Hourly Amount or Fixed Amount.

|

| Amount |

Enter a percentage or amount, depending on the calculation method selected. You should enter a percentage for Fixed Percentage of Earnings, or an amount for Fixed Hourly Amount or Fixed Amount. |

| Maximum per Year |

Enter the maximum amount allowed for benefits per calendar year. If there is no limit, enter a large number like 9,999,999,999 to be applied as the maximum. If the box is left at 0, 0 is applied as the maximum per year, and you will not get a benefit amount. |

|

Maximum Percentage |

Enter the maximum percentage allowed for a benefit, when Percentage on Timesheet is selected. When entering percentages include a decimal point. The percentage can range from zero to 100 percent. The system calculates up to four places to the right of the decimal point.

|

Note: This section is only available if the Fixed Percentage of Earnings, Fixed Hourly Amount, or Percentage on Timesheet calculation methods were selected.

Select the Earning Codes to use when calculating this benefit.

Any Earning Code set up with "Contribute to Net Pay Only" (see Payroll Earning Codes) is not available to use when calculating this benefit.

Assign a payroll schedule to the Benefit Code. This schedule helps the system determine whether or not to use a particular benefit code when creating a Regular/Supplemental timesheet for an employee.

Note: A schedule is required for all cycles and payroll types (regular and supplemental). If no changes are made to this tab, the system uses the default, "Always".

| Monthly |

Choose from "Always" or "Never" for Regular and Supplemental Payroll. |

| Semimonthly |

|

| Biweekly |

|

|

Weekly |

|

Use this section to determine which federal, state, and other taxes to apply for this Benefit Code. When a check box is selected, the employee's earnings are increased by the amount of the deduction for the selected tax.

Federal Taxes

Select Federal Income (FIT), Social Security, Medicare, and/or Federal Unemployment (FUTA), as appropriate for this benefit code.

State Taxes

Select State Withholding Tax (SWT) and/or State Unemployment Tax (SUTA), as appropriate for this benefit code.

Other Taxes

Select Employee Paid (LWT) and/or Employer Paid (LER), as appropriate for this benefit code.

Use this section to specify how the system should distribute the benefit.

Follow Earnings on Timesheet: Select to have benefit amounts distributed the same way the employee's earnings are distributed. Select an alternate distribution code to use when no earnings are present on the timesheet. When earnings exist, the benefit is distributed to the same Account Codes (Fund and any other account segments except General Ledger) as the employee's earnings. Also, if more than one distribution code is used to distribute the employee's earnings, the benefits are distributed based upon a weighted average of the distributed earnings.

Follow Earnings Used to Calculate the Benefit: Select to limit distribution to the earnings used to calculate the benefit (from the Earning Codes specified on the Earnings tab). Many grants and contracts allow benefits to be charged directly to the funding source. The benefit is distributed to the same Account Codes (Fund and any other account segments except General Ledger) as the employee's earnings. If more than one distribution code is used to distribute the employee's earnings, the benefits are distributed based upon a weighted average of the distributed earnings.

Use Distribution Code: Select an existing distribution code to distribute the benefit, which may be entirely or partially distributed to overhead. Use this distribution method if there is one or more funding sources to which you do not distribute benefits (because there is a negotiated rate or benefits are simply disallowed). Distribution codes must have been previously created (see Distribution Code Record) with "Apply To" set to Payroll only (P), or both Accounting and Payroll (B).

When you are finished making your changes, click  .

.

Frequently asked questions about Payroll Benefit Codes

Yes. To transfer accounting data for benefits when no earnings are entered on the timesheet, go to Payroll>System Setup>Payroll Codes>Benefit Codes, select "Follow Earnings on Timesheet" in the "Benefit Distribution" section of the benefit code form, and enter a distribution code in the "Distribution Code to Use if no Earnings Exist" field. See Payroll Benefit Codes for more information.