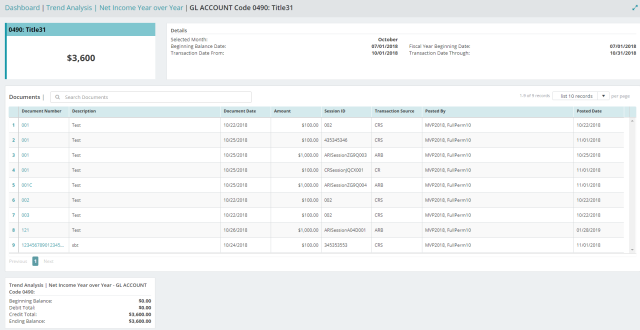

Trend Analysis | Net Income Year over Year | GL Code

The GL Code Net Income Year over Year screen displays when you click on the amount total for the current year in the Codes grid on the Net Income Year over Year page. It displays the documents for the selected GL Code.

GL Code

Displays the dollar amount total for the selected GL code.

Details

Selected Month: Displays the month that was selected on the Trend Analysis chart.

Beginning Balance Date: Displays the date of the beginning of an accounting period.

Fiscal Year Beginning Date: The first day of the fiscal year for which you are entering transactions.

Transaction Date From: Specifies the start date of the month for the transaction.

Transaction Date Through: The system displays the actual transactions through the current date (the date you log into the system) when you are viewing the current month, otherwise, it specifies the end of the month date for the selected period.

Documents

To search for a specific document, enter the document number into the search box at the upper left of the table.

Document Number: The system displays the document number. Click to display the Transactions session related to the document.

Description: The description of the document.

Document Date: The invoice, credit, or receipt date entered on the transaction document.

Amount: The amount displayed on the document.

Session ID: The session ID assigned to the batch of documents.

Transaction Source: The transaction type for the documents, such as APC, API, APM, APS, APV, ARB, ARM, ARP, ARC, ARS, CD, CDS, CR, CRS, JV, JVA, JVD, PRC, PRS, PRV, or VCK.

Posted By: The system displays the user name who posted the document.

Posted Date: The date the document was posted.

Trend Analysis/ Net Income Year over Year - GL Code

The system displays a snapshot for net income year over year for the selected GL code:

Beginning Balance: The total balance at the beginning of an accounting period.

Debit Total: The total amount of all debit transactions.

Credit Total: The total amount of all credit transactions.

Ending Balance: This balance is calculated by taking the Beginning Balance and applying the current activity (Debit Totals and Credit Totals).