Payroll Federal Taxes

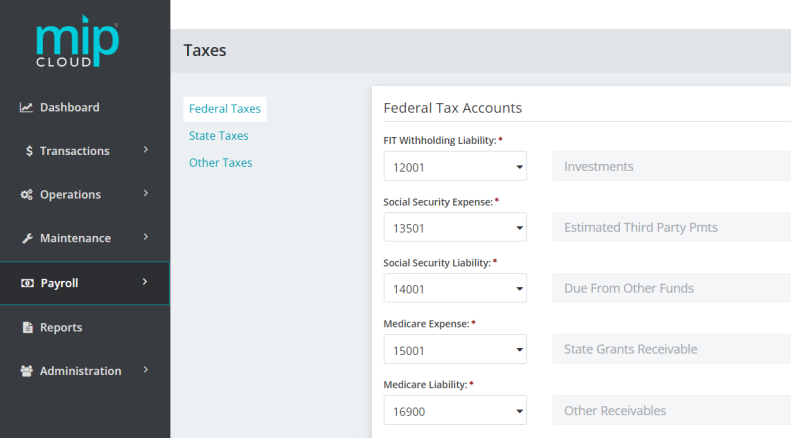

Use this form to specify how the system is to account for the federal tax withheld from employees' checks. This not only accommodates the employee's federal tax withholding, but also the employer-paid federal tax expense. You can also specify federal unemployment tax information.

Make your way down the form, filling in all required fields.

Click a dropdown link below to learn more about the fields in each section of the form.

| FIT Withholding Liability |

This is the liability account for Federal Withholding Taxes. |

| Social Security Expense | This is the General Ledger expense account for Social Security Taxes. |

| Social Security Liability | This is the General Ledger liability account for Social Security Taxes. |

|

Medicare Expense |

This is the General Ledger expense account for Medicare. |

|

Medicare Liability |

This is the General Ledger liability account for Medicare. |

|

Federal Unemployment Expense |

This is the General Ledger expense account for Federal Unemployment Tax. |

|

Federal Unemployment Liability |

This is the General Ledger liability account for Federal Unemployment Tax. |

Note: Expense Accounts are only used for the employer portion of applicable taxes.

Social Security Tax

Use this section to edit the employee's federal withholding tax information for Social Security. The system defaults to the current federal values for "Maximum Annual Subject Wages" and "Percent of Wages". This will effect every employee's federal taxes. The system displays the current and past year's official federal withholding tax values.

| Override Official Values | Select this check box to enable the "Maximum Annual Subject Wages" and "Percent of Wages" fields, so that you can manually enter the wage information for these fields. |

| Calculation Method |

Accept the default of "(Y) Year To Date" or select a Calculation Method of "(C) Current".

|

|

Maximum Annual Subject Wages |

Accept the default or enter the employee's maximum subject wages for the Social Security tax. |

|

Percent of Wages |

Accept the default or enter the employee's percentage of maximum subject wages for the Social Security tax. |

|

20xx and 20xx Official Values |

The values displayed in these fields are the official federal rates for the current and prior year. Displayed are the Maximum Annual Subject Wages and Percent of Wages for the Social Security tax. |

Medicare Tax

The system displays the "Maximum Annual Subject Wages" and "Percent of Wages" for the Employee's Medicare Tax. This effects every employee's federal taxes. The system displays the current and past year's official federal withholding tax values.

|

Maximum Annual Subject Wages |

The system displays the maximum subject wages for the Medicare tax. |

|

Percent of Wages |

The system displays the percentage of maximum subject wages for the Medicare tax. |

|

20xx and 20xx Official Values |

The values displayed in these fields are the official federal rates for the current and prior year. Displayed are the Maximum Annual Subject Wages and Percent of Wages for the Medicare tax. |

Social Security Tax

Use this section to edit the employer's federal withholding tax information for Social Security. This effects the employer-paid federal taxes. The system defaults to the current federal values for "Maximum Annual Subject Wages" and "Percent of Wages". The system displays the current and past year's official federal withholding tax values.

| Override Official Values | Select this check box to enable the "Maximum Annual Subject Wages" and "Percent of Wages" fields, so that you can manually enter the wage information for these fields. |

| Calculation Method |

Accept the default of "(Y) Year To Date" or select a Calculation Method of "(C) Current".

|

|

Maximum Annual Subject Wages |

Accept the default or enter the maximum subject wages for the Social Security tax. |

|

Percent of Wages |

Accept the default or enter the percentage of maximum subject wages for the Social Security tax. |

|

20xx and 20xx Official Values |

The values displayed in these fields are the official federal rates for the current and prior year. Displayed are the Maximum Annual Subject Wages and Percent of Wages for the Social Security tax. |

Medicare Tax

The system displays the "Maximum Annual Subject Wages" and "Percent of Wages" for the Medicare Tax. This effects the employer-paid federal taxes. The system displays the current and past year's official federal withholding tax values.

|

Maximum Annual Subject Wages |

The system displays the maximum subject wages for the Medicare tax. |

|

Percent of Wages |

The system displays the percentage of maximum subject wages for the Medicare tax. |

|

20xx and 20xx Official Values |

The values displayed in these fields are the official federal rates for the current and prior year. Displayed are the Maximum Annual Subject Wages and Percent of Wages for the Medicare tax. |

Use this section to edit the employer paid federal unemployment tax information. The system defaults to the current federal values for "Maximum Annual Subject Wages" and "Percent of Wages".

| Override Official Values | Select this check box to enable the "Maximum Annual Subject Wages" and "Percent of Wages" fields, so that you can manually enter the wage information for these fields. |

|

Maximum Annual Subject Wages |

Accept the default or enter the maximum subject wages for the Federal Unemployment tax. |

|

Percent of Wages |

Accept the default or enter the percentage of maximum subject wages for the Federal Unemployment tax.

|

|

20xx and 20xx Official Values |

The values displayed in these fields are the official federal rates for the current and prior year. Displayed are the Maximum Annual Subject Wages and Percent of Wages for the FUTA tax. |

Note: If the override checkbox is unchecked after you made changes to the "Maximum Annual Subject Wages" or "Percent of Wages" fields, the system returns to the default current year official values.

Note: The FUTA rate is based on the existence of SUTA. When state tax information was set up (see Payroll State Taxes), if the State Unemployment Tax checkbox was not selected, or if the SUTA Percentage of Wages was 0%, the amount of FUTA calculated for the state will be 6.0%. Otherwise, FUTA will be calculated at .6%.

Use this section to specify how to distribute the employer's portion of the federal tax expense.

Follow Earnings on Timesheet: The tax is distributed to the same Account Codes (except General Ledger) as the employee's earnings on their timesheet. If more than one distribution code is used to distribute the employee's earnings on the timesheet, the taxes are distributed based upon a weighted average of the distributed earnings.

Follow Earnings Used to Calculate the Tax: Limits the distribution used to calculate the tax to the earning codes specified. The tax is distributed to the same Account Codes (except General Ledger) as the employee's earnings. If more than one distribution code is used to distribute the employee's earnings, the taxes are distributed based upon a weighted average of the distributed earnings.

Use Distribution Code: Use this distribution method if there are one or more funding sources to which you do not distribute federal taxes.

Note: If there are one or more funding sources to which you do not distribute federal taxes (because you may have a negotiated rate or federal taxes are simply disallowed), you can choose the Use Distribution Code distribution method. For this method, specify the exact Distribution Code to distribute the federal taxes, which may be entirely or partially distributed to overhead. If a Distribution Code is specified in this section, it should be an existing Distribution Code.

Note: Many grants and contracts allow federal taxes to be charged directly to the funding source. In this case, choose Follow Earnings on Timesheet or Follow Earnings Used to Calculate the Tax. The employer's portion of the federal taxes is distributed to the same Account Codes (Fund and any other account segments except General Ledger) as the employee's earnings. In other words, the Distribution Codes used to distribute the employee's earnings are also used to distribute the federal tax. If more than one Distribution Code is used to distribute the employee's earnings, the federal taxes are distributed based upon a weighted average of the distributed earnings.

Note: The selected distribution method only applies to employer-paid taxes, such as FUTA, Social Security, and Medicare.

Note: The calculation of federal tax FIT and MC are provided by the system; the official values for FUTA, FICA, and SS are also provided but can be manually maintained if mid-year adjustments occur before a normal software update. The earning, benefit, and deduction amounts that are flagged as subject to the specified federal tax are used in the calculation of the tax.

When you are finished making your changes, click  .

.