Payroll Earning Codes

Use this form to add a new Earning Code or edit an existing one. Distribution of Earnings is determined on the employee's timesheet.

The earning codes entered are used throughout the system. The system uses earning codes when it is calculating pay, creating an accounting entry for payroll, calculating and reporting W-2 information and other tax reports, and reporting.

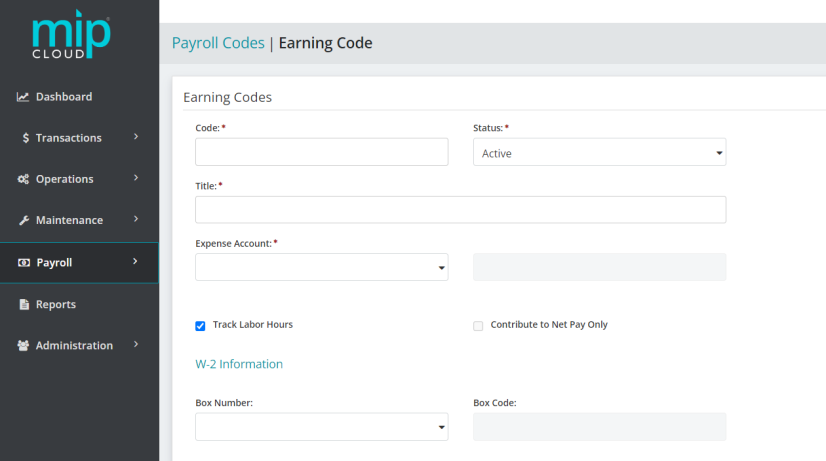

The landing page when adding or editing an earning code.

Note: For Salaried employees, you can distribute wage hours based on earning codes. On an employee's timesheet, select multiple earning codes with the calculation method "Employee Pay Rate (ER)" and enter the employee’s Hours and Distribution Codes; the system will use the hours to break down earnings by dollar amount for each wage code. You can view the wages with hours and net check amount that was contributed by that wage code when processing payroll.

Click a dropdown link below to learn more about the fields in each section of the form.

| Code |

Enter an Earning Code. You should make the first eight characters of the code unique so that the paycheck displays a useful identifier. We recommend limiting your entry to strictly alphabetic characters (A through Z) or numeric characters (0 through 9), and avoiding the use of symbols. |

| Status |

Specify the status of the code. The status can be changed at any time. Below are valid status entries and their descriptions:

|

| Title | Enter the title of the Earning Code. |

|

Expense Account |

Enter the General Ledger expense account for this Earning Code. The account must be an existing General Ledger account that is not a subledger-type account. The account must have a status of Active or Inactive.

|

|

Track Labor Hours |

Select this checkbox to track the employee labor hours entered on any timesheet. The system distributes the hours entered on the timesheet, using the same percentages applied to the earnings dollars when the distribution codes were created.

|

|

Contribute to Net Pay Only |

Select this checkbox to process employee reimbursement and advances through regular payroll processing (by applying the net pay amount without the amount being subject to taxes and fringe benefits).

|

|

W-2 Information Box Number |

Select W-2 Box Number 7, 8, 10, 11, 12, or 14 if this code falls into one of those W-2 categories.

|

Note: Earnings are money paid to an employee, which increases net pay. A benefit, on the other hand, is something provided to the employee for which the employer pays a third party (they do not increase net pay). For example, life insurance for an employee that exceeds the federally allowed maximum, and use of a company car for personal reasons, are benefits. These benefits do not increase the employee's net pay, but must be included as taxable income to the employee (and thus they increase taxable earnings and applicable taxes). Use this distinction when determining whether to enter an item as an Earning or a Benefit Code.

Choose a calculation method for this earning code. The available methods are:

Employee Pay Rate: Select this method to calculate earnings using the employee's salary or hourly pay rate (see Employee Information). This calculation method is typically used for standard employee wages. If an employee is salaried, the employee's salary per pay cycle is the earning amount. However, if multiple earning codes are used, then the amount is divided between the hours entered on the timesheet for each earning code. If the employee is hourly, the earning amount is the employee's hourly rate multiplied by the hours on the timesheet for that earning code.

Rate Multiplier: Select this method to have the system take the employee's hourly rate (or the equivalent hourly rate if the employee is salaried) from the Employee Information form (see Employee Information), and multiply it by the value specified in the "Rate" box. The result is then multiplied by the hours on the employee's timesheet for the earning code. This calculation method is typically used for cases such as time and one half for overtime hours, where a multiplier of 1.5 would be set.

Fixed Hourly Amount: Select this method to have the system multiply the amount specified in the "Amount" box, by the number of hours specified on the employee's timesheet. When using an earning code that is set up with a fixed amount, the fixed hourly amount is substituted for the pay rate that was set up for the employee on the Employee Information form (see Employee Information). You might set up one or more of these codes if an employee worked on several projects where different hourly rates are charged.

Fixed Amount: Select this method when an earning is based on a fixed amount per pay cycle. Enter a fixed earning amount (in the "Amount" box) to calculate payroll. Use this calculation method if a fixed amount is needed for an earning in addition to an employee's regular wages.

Amount on Timesheet: Select this method to have the system use the fixed amount that is entered on the employee's timesheet. Use this method to enter an actual amount on the timesheet for earnings.

Rate on Timesheet: Select this method to have the system calculate the number of hours, by the hourly rate which are both entered on the employee's timesheet. The rate entered on the timesheet is substituted for the pay rate that was set up for the employee on the Employee Information form (see Employee Information). You might set up one or more of these codes if an employee worked on several projects where different hourly rates are charged. Use this calculation method to pay employees different pay rates based on jobs performed, or if you have paid shift differentials, such as different rates if they work the "graveyard" shift.

Note: Note that there is no internal default Earning Code for wages. The code must be created in Payroll>System Setup>Payroll Codes, then assign it a calculation method of "Employee Pay Rate" (ER).

Choose a calculation method, then fill out the following fields as required by the calculation method:

| Rate |

Enter a rate. This field is editable when the Rate Multiplier calculation method is selcted. |

| Amount |

Enter an amount. This field is editable when the Fixed Hourly Amount or Fixed Amount calculation methods are selected. |

Assign a payroll schedule to the code. This schedule helps the system determine whether or not to use a particular payroll code when creating a Regular/Supplemental timesheet for an employee.

Note: A schedule is required for all cycles and payroll types (regular and supplemental). If no changes are made to this tab, the system uses the default, "Always".

| Monthly |

Choose from "Always" or "Never" for Regular and Supplemental Payroll. |

| Semimonthly |

|

| Biweekly |

|

|

Weekly |

|

Use this section to determine which federal, state, and other taxes to apply for this code. When a checkbox is selected, the employee's earnings are subject to the selected tax. Since earnings are typically taxable, the system automatically has all check boxes selected.

Note: If the "Contribute to Net Pay Only" check box is selected, taxes do not apply, so this section will not be available.

Federal Taxes

Select Federal Income (FIT), Social Security, Medicare, and/or Federal Unemployment (FUTA), as appropriate for this code.

State Taxes

Select State Withholding Tax (SWT) and/or State Unemployment Tax (SUTA), as appropriate for this code.

Other Taxes

Select Employee Paid (LWT) and/or Employer Paid (LER), as appropriate for this code.

Note: For State and/or Other Taxes, you must assign State and/or Other tax codes to an employee (see Employee Information), to calculate these selected taxes.

When you are finished making your changes, click  .

.