Setting up City Tax Information

You can set up city or zip code tax rates from the State Tax Information Profile. The city tax amount will automatically be added to the total purchase of a product during Check Out based on the city or zip code the item is being shipped to.

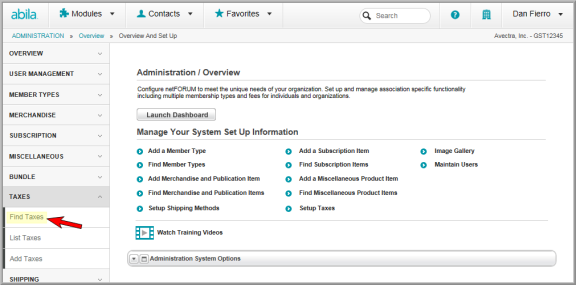

To go to the State Tax Information Profile:

- Hover over the Modules tab in the top navigation bar. In the fly out menu, click Administration. The Administration/Overview page will appear.

- Expand the Taxes group item.

- Click Find Taxes.

- On the Find-Taxes page, select the State.

- Click Go.

- On the List Taxes page, click the go to

arrow next to the desired tax.

arrow next to the desired tax.

The Tax Information Profile shows the Country, State, Tax Percentage, and Charge Code.

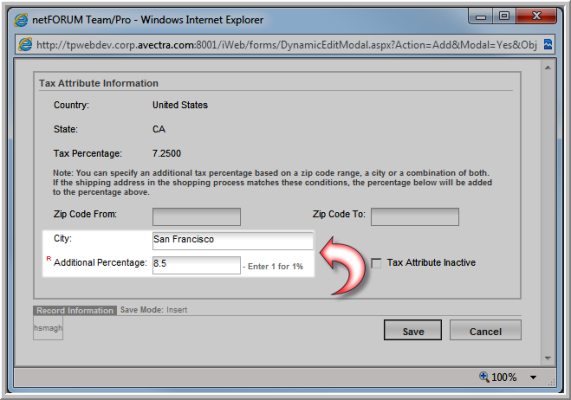

To set up City Tax in the Tax Information Profile:

- On the Tax Information Profile, locate the Tax Attributes child form and click the Add

icon..

icon.. - In the Tax Attribute Information window, enter the City.

- Enter the Additional Percentage.

- Click Save.

The City and Tax Percentage display on the Tax Attributes child form.

To set up tax based on Zip Code Range:

- On the Tax Attributes child form, click Add.

- In the Tax Attribute Information window, enter the zip code range in the Zip Code From and Zip Code To fields.

- Enter the Additional Percentage.

- Click Save.

The Zip Code Range and Tax Percentage display on the Tax Attributes child form.