Select Processing Groups

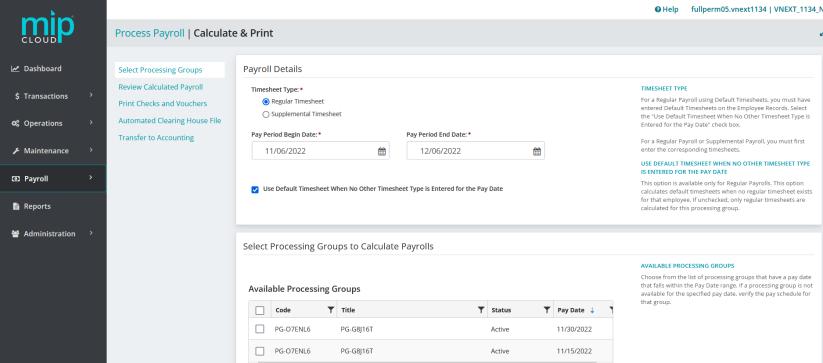

Use this form to calculate payroll from timesheets.

In order to process payroll, you must have entered at least one timesheet (regular or supplemental) through the Add Timesheets form, or have at least one default timesheet entered for an employee (see Employee Default Timesheet).

Note: If you are going to process payroll using default timesheets, be sure to select the "Use Default Timesheet When No Other Timesheet Type is Entered for the Pay Date" check box in the Payroll Details section of the form. This check box is only available when you select the "Regular Timesheet" option.

The Select Processing Groups tab is split into two sections: Payroll Details and Select Processing Groups to Calculate Payrolls.

Payroll Details

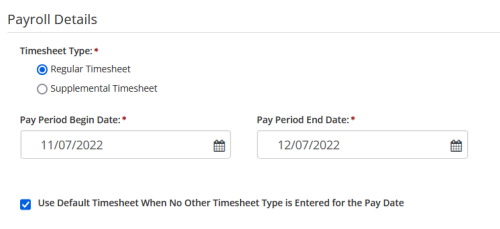

Timesheet Type: Select either "Regular" or "Supplemental" to indicate the type of payroll you want to calculate.

Pay Period Begin and End Date: Enter the date range for the calculated payroll, if necessary. This date range defaults to a "Begin" date of 14 days prior to the current system date, while the "End" date is 14 days after. This range can be modified to include pay dates which fall outside the default date range.

Use Default Timesheet When No Other Timesheet Type is Entered for the Pay Date: This option is available only for Regular Payrolls. Select this box to use any Default Timesheets that have been entered for employees. This option causes default timesheets in the selected processing groups to be calculated when no regular timesheet exists for that employee. If unchecked, only regular timesheets are calculated for this processing group (see Add Timesheets).

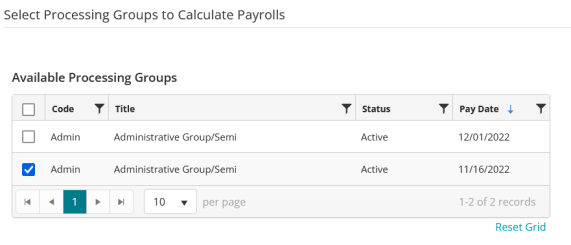

Select Processing Groups to Calculate Payrolls

Select the processing group to process payroll for.

When you are finished making your selections, click  . Then, proceed to Review Calculated Payroll.

. Then, proceed to Review Calculated Payroll.

Frequently asked questions

Suppose you calculate a Regular Payroll for a processing group that includes some employees for which you must enter timesheets and some employees for which the system uses Default Timesheets. If you forget to check the "Use Default Timesheet When No Other Timesheet Type is Entered for the Pay Date" box before you calculate payroll, the system will not calculate payroll for the employees that have Default Timesheets. Therefore, the payroll calculation will be incomplete.

To remedy the situation, calculate the same payroll again, making sure to select the "Use Default Timesheet When No Other Timesheet Type is Entered" for the Pay Date box. The system only calculates payroll for those employees that have Default Timesheets because the other employees have already been calculated. The new calculations are added to the Calculated Payroll file, and when pay checks are printed, all of the employees are included.

The "Available Processing Groups" table only displays processing groups that have a pay date that falls within the Pay Period Begin and Pay Period End dates. Change the dates in these fields to include the pay date for the processing group you are looking for. To review your processing group pay schedule, go to Payroll>System Setup>Payroll Codes>Processing Groups (for more information, see Payroll Processing Groups).