Other Taxes Rate Tables

When creating an "Other Taxes" tax code, the table below shows which calculation type is available to the Employee and/or Employer.

| Calculation Type | Employee | Employer |

| Annual Base Tax | X | |

| Annual Tiered Tax | X | |

| Annual Tiered Tax with Cap Option | X | |

| Base Tax per Period with Minimum Wage Threshold | X | X |

| Fixed Amount | X | |

| Percent of Annual Wages with Cap Option | X | |

| Percent of Wages with Cap Option | X | |

| Percent of Wages with Pay Cycle Cap Option | X |

For a detailed description of a calculation type, with examples, click a link below.

Suppose you have a tax that is a set annual amount of $60, regardless of income. The annual amount is entered in the Base Tax column. Below is an example of the Annual Base Tax:

In this case, the system simply divides the tax by the employee's number of pay periods to determine the employee's tax per paycheck. So, employees that are paid monthly would be assessed a $5 tax every pay period (60/12 = 5).

Suppose you have a tax that has rate changes based on income levels, such as follows:

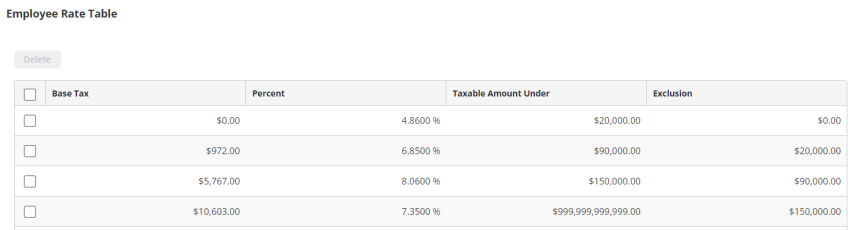

If the taxable earnings are $0.00 to $20,000.00, the base tax is $0.00, the rate is 4.86%, and there is no exclusion amount.

If the taxable earnings are $20,000.01 to $90,000.00, the base tax is $972.00, the rate is 6.85%, and there is an exclusion of $20,000.00.

If the taxable earnings are $90,000.01 to $150,000.00, the base tax is $5,767.00, the rate is 8.06%, and there is an exclusion of $90,000.00.

If the taxable earnings are over $150,000.01, the base tax is $10,603.00, the rate is 7.35%, and there is an exclusion of $150,000.00.

If there is no limitation on taxable earnings , enter a large value such as 999,999,999.99 as the Taxable Amount Under value in the last row of the table.

The base taxes are entered in the "Base Tax" column, the rates are entered in the "Percent" column, the ranges in taxable earnings are represented in the "Taxable Amount Under" column, and the exclusions are entered in the "Exclusion" column.

The cap will be applied based on the last value entered as the "Taxable Amount Under" in the last row of the table. Below is an example of the Annual Tiered Tax:

In this case, an employee has annualized taxable wages of $62,000. The system uses line 2 to determine the exclusion tax as follows:

The system taxes the second tier, based on the example of a $62,000 salary, equates to $42,000 (62,000-20,000) and is taxed at 6.85%; which equals an additional $2877.00 in taxes. Finally, the system adds the base tax of $972.00 to the second tiers tax of $2877, and gets a total annual Other Tax of $3849.00. Assuming the employee is paid semi-monthly, the system divides $3849.00 by 24 to get $160.375 and deducts that amount from the employee's paycheck each pay period.

Suppose you have a tax that has rate changes based on income levels, such as follows:

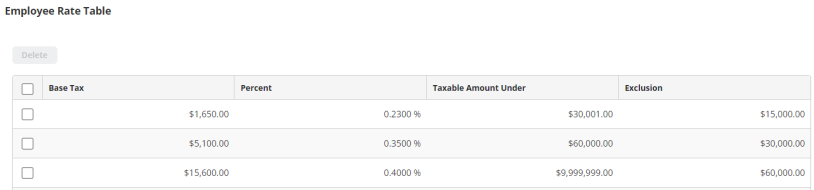

If the taxable earnings are $0.00 to $30,001.00, the base tax is $1,650.00, the rate is .23%, and there is an exclusion of $15,000.

If the taxable earnings are $30,000.01 to $60,000.00, the base tax is $5,100.00, the rate is .35%, and there is an exclusion of $30,000.

If the taxable earnings are $60,000.01 to $9,999,999.00, the base tax is $15,600.00, the rate is .4%, and there is an exclusion of $60,000.

If there is no limitation on taxable earnings, enter a large value such as 999,999,999.99 as the Taxable Amount Under value in the last row of the table.

The base taxes are entered in the "Base Tax" column, the rates are entered in the "Percent" column, the ranges in taxable earnings are represented in the "Taxable Amount Under" column, and the exclusions are entered in the "Exclusion" column.

The cap will be applied based on the last value entered as the "Taxable Amount Under" in the last row of the table. Below is an example of the Annual Tiered Tax with Cap Option.:

In this case, an employee has annualized taxable wages of $58,000. The system uses line 2 to determine the exclusion tax as follows:

The system taxes the second tier, based on the example of a $58,000 salary, equates to $28,000 (58,000-30,000) and is taxed at .35%; which equals an additional $98.00 in taxes. Finally, the system adds the base tax of $5,100.00 and gets a total annual Other Tax of $5,198.00. Assuming the employee is paid bi-monthly, the system divides $5,198.00 by 26 to get $216.5833 and deducts that amount from the employee's paycheck each pay period.

The detailed calculation steps are as follows:

-

Calculate the total annualized tax amount for the current check/voucher

-

Gross taxable earnings multiplied by the number of pay periods to annualize the earnings

-

Subtract the annual exemption amount based the number of exemptions for the employee

-

Determine the applicable tier for the annualized subject taxable earnings

-

Subtract the applicable Exclusion amount from the annualized subject taxable earnings

-

Multiple the annualized subject taxable earnings over the exclusion by the Percentage

-

Add the Base Tax amount to the calculated tax amount which results in the total annualized tax amount

-

-

Calculate the YTD tax amount withheld for the year

-

Calculate the maximum tax amount for the current check/voucher

-

Take the applicable tier Taxable Amount Under minus the Exclusion and multiplied by the Percentage

-

Add the Base Tax

-

-

Determine the amount of LWT tax to be withheld

-

Add the total annualized tax amount to the YTD tax amount

-

If the current YTD tax amount is less than the maximum tax for the tier

-

Divide the total annualized tax amount by the number of pay periods to get the LWT tax to withhold

-

-

If the current YTD tax amount is greater than the maximum tax for the tier

-

Subtract the YTD tax amount from the maximum tax amount

-

If the tax amount is less than zero then set it to zero

-

-

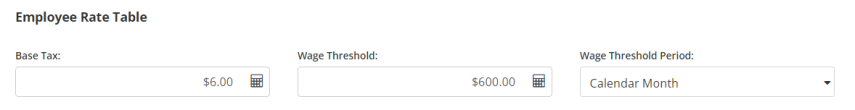

Suppose you have a flat amount of tax that must accrue once a month, after a minimum amount (or threshold) of taxable wages are earned during that month.

If the employee that is paid semimonthly and earns $800 during the first pay period of the month, they will have the base tax of $6.00 withheld from their pay check. Then, in the second pay period of the month, nothing will be withheld for the tax, as the Wage Threshold of $600 was met in the first pay period. Note that because the wage threshold period is Calendar Month, the Base Tax will reset in the first pay period of the following months.

If the employee is paid $400 and does not meet the Wage Threshold in the first pay period of the Wage Threshold Period, no Base Tax will be withheld on the pay check. In the next pay period, the employee is paid $400, if the pay period occurs within the same Wage Threshold Period, and the employee's total earnings at that time equals or exceeds the Wage Threshold ($400+$400=$800>$600), then the Base Tax $6 will be withheld.

If the Wage Threshold is not met in the Wage Threshold Period, the Base Tax will not be withheld from the employee's pay check for that Wage Threshold Period.

Note: The withholding tax is only accrued once per Wage Threshold Period.

Note: In the event this calculation type is applied as an employer tax, all the rules are the same except the system will accrue a tax expense rather than withholding from the employee.

Suppose you have a withholding tax that has a maximum amount of earnings taxed at $12,000 and a rate of .5%. Below is an example of the Percent of Annual Wages with Cap Option Tax:

In this case, if the employee earns $5,000 monthly in taxable wages, the system multiplies the rate of .5% (entered in the Percent column) by the taxable wages ($5000x.005=$25). The employee has $25 withheld for this pay check until the maximum amount of earning $12,000 (entered in the Taxable Amount Under column) is met which would be in the third pay period ($5000+$5000+$5000=$15000>$12000).

If the calculation Method is Current, then in the above scenario, the system calculates tax based on the current check only. It does not consider year-to-date accrued taxes.

If the Calculation Method is Year to Date, then in the above scenario the system will perform a Year to Date approximation and adjusts the current withholding tax to match what the tax should be according to the approximation. SeePayroll Calculating Other Withholding Taxes for more information.

Note: In the event this calculation type is applied as an employer tax, all the rules are the same except the system will accrue a tax expense rather than withholding from the employee.

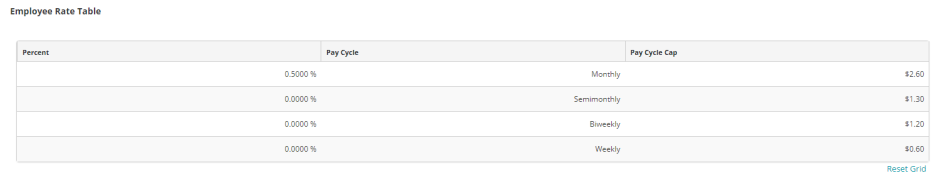

Suppose you have a flat rate with an amount cap by payroll period, such as some state disability insurance or temporary disability insurance. In this case, an employee has a state disability insurance base of .5% to maximum of $0.60 per week rate. Below is an example of the Percent of Wages with Pay Cycle Cap Option:

In this case, an employee has annualized taxable wages of $50,000 and is paid Biweekly. Their state disability insurance has an amount cap of $1.20 per pay period. The system uses line 3 to determine the pay cycle cap as follows:

Because the employee get's paid Biweekly, the annualized taxable wages of $50,000 are divided by 26 (the number of pay cycles in one year) to get the pay cycle cap amount of 1923.08. The rate is multiplied by the amount to get $9.62 per pay check. However, the employee cannot pay more then $1.20 per pay check, so $1.20 is deducted from the employee's pay check for state disability insurance.