Payroll Other Taxes

Use this form to set up tax codes for the localities in which your employees are subject to tax, as well as most State Disability Insurance (SDI), and Temporary Disability Insurance (TDI) withholding and expensing formulas. In each section, specify how to calculate and account for these other taxes. Additionally, you can specify how to distribute the Employer tax (if any).

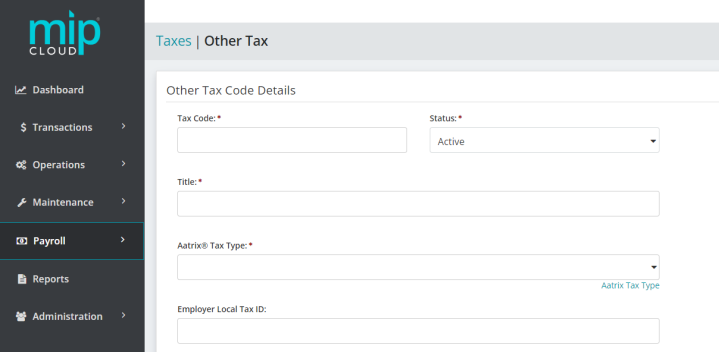

Make your way down the form, filling in all required fields.

Click a dropdown link below to learn more about the fields in each section of the form.

| Tax Code |

Enter a new tax code.

|

| Status |

Specify the status of the code. The status can be changed at any time. Below are valid status entries and their descriptions:

|

| Title | Enter the description of the tax code. |

|

Aatrix ® Tax Type |

Select the appropriate Aatrix Tax Type for local or other tax types.

|

|

Employer Local Tax ID |

Enter the employer tax ID number for the tax code. |

Applicable Taxes

Select whether the tax is paid by the Employee and/or Employer for the designated code.

Note that Employee is not an employer expense and therefore is not distributed as an expense.

If the "Employee Applicable Taxes" checkbox is selected, the Employee Taxes section becomes available; likewise, if "Employer Applicable Taxes" is selected, that section will become available.

Use this section to specify how the system should account for the employee withholding tax. Select the Withholding Tax's calculation basis, the General Ledger Liability Account, and the calculation type. The Employee Rate Table displays columns based on the Calculation Type selected. Enter exemptions/deductions, if applicable.

| Calculation Basis |

Select a calculation basis to determine the subject wages to be used for calculating the other tax.

|

| Employee Liability Account |

Enter the General Ledger Liability Account for withholding tax. The Liability Account must be an existing Active or Inactive General Ledger account that is not a subledger-type account. |

|

Employee Calculation Type |

Select the calculation type and use the employee rate table to set up the tax calculation. The following describes each calculation type: Annual Base Tax: Taxes are calculated according to a fixed amount. Annual Tiered Tax: Tax rates change based on income levels, multiple lines are needed. Annual Tiered Tax with Cap Option: Tax rates change based on income levels, multiple lines are needed. Base Tax per Period with Minimum Wage Threshold: Taxes are calculated according to a fixed amount after a minimum wage amount is met for the pay period. Percent of Annual Wages with Cap Option: Taxes are calculated on a year-to-date or current pay period basis according to a flat percentage. Percent of Wages with Pay Cycle Cap Option: Taxes are calculated on a pay period basis according to a flat percentage. |

|

Employee Rate Table |

The amounts and percentages entered in this table are used in the calculation of the withholding tax. You must complete at least one line of this table if the Employee Applicable Taxes check box was selected on the Tax Code tab. The available fields change depending on the Calculation Type selected. For an in-depth description of each calculation type, with examples, see Payroll Calculating Other Withholding Taxes. |

Use this tab to specify how to account for and calculate employer paid taxes, if any.

| Expense Account | Enter the General Ledger expense account for the Employer's Paid Tax. The Expense Account must be existing, Active or Inactive General Ledger account that is not a subledger-type account. |

| Liability Account |

Enter the General Ledger liability account for the Employer's Paid Tax. The Liability Account must be an existing, Active or Inactive General Ledger account that is not a subledger-type account. |

|

Employer Calculation Type |

Select the calculation type and use the employer rate table to set up the tax calculation. The following describes each calculation type:

|

|

Employee Rate Table |

The amounts and percentages entered in this table are used in the calculation of the withholding tax. You must complete at least one line of this table if the Employer Applicable Taxes check box was selected on the Tax Code tab. The available fields change depending on the Calculation Type selected. For an in-depth description of each calculation type, with examples, see Payroll Calculating Other Withholding Taxes. |

Use this section to specify how to distribute the employer's portion of the other tax expense.

Follow Earnings on Timesheet: The tax is distributed to the same Account Codes (except General Ledger) as the employee's earnings on their timesheet. If more than one distribution code is used to distribute the employee's earnings on the timesheet, the taxes are distributed based upon a weighted average of the distributed earnings.

Follow Earnings Used to Calculate the Tax: Limits the distribution used to calculate the tax to the earning codes specified. The tax is distributed to the same Account Codes (except General Ledger) as the employee's earnings. If more than one distribution code is used to distribute the employee's earnings, the taxes are distributed based upon a weighted average of the distributed earnings.

Use Distribution Code: Use this distribution method if there are one or more funding sources to which you do not distribute federal taxes.

Note: If there are one or more funding sources to which you do not distribute federal taxes (because you may have a negotiated rate or federal taxes are simply disallowed), you can choose the Use Distribution Code distribution method. For this method, specify the exact Distribution Code to distribute the federal taxes, which may be entirely or partially distributed to overhead. If a Distribution Code is specified in this section, it should be an existing Distribution Code.

Note: Many grants and contracts allow federal taxes to be charged directly to the funding source. In this case, choose Follow Earnings on Timesheet or Follow Earnings Used to Calculate the Tax. The employer's portion of the federal taxes is distributed to the same Account Codes (Fund and any other account segments except General Ledger) as the employee's earnings. In other words, the Distribution Codes used to distribute the employee's earnings are also used to distribute the federal tax. If more than one Distribution Code is used to distribute the employee's earnings, the federal taxes are distributed based upon a weighted average of the distributed earnings.

Note: The selected distribution method only applies to employer-paid taxes, such as FUTA, Social Security, and Medicare.

Note: The calculation of federal tax FIT and MC are provided by the system; the official values for FUTA, FICA, and SS are also provided but can be manually maintained if mid-year adjustments occur before a normal software update. The earning, benefit, and deduction amounts that are flagged as subject to the specified federal tax are used in the calculation of the tax.

When you are finished making your changes, click  .

.

More information on calculating other taxes, and examples with calculation methods

See Other Taxes Rate Tables for examples on calculation methods available in "Other Taxes", or visit Payroll Calculating Other Withholding Taxes for a breakdown on how withholding taxes are calculated using the information in the system.

For information on calculating taxes for Mississippi, Marianas Protectorate, Massachusetts, Republic of Marshall Islands, and Republic of Palau, see Miscellaneous State Taxes.