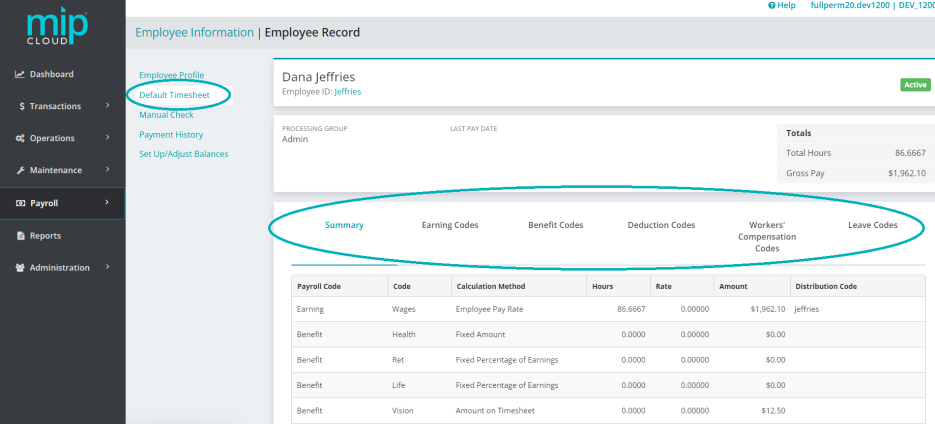

Employee Default Timesheet

The Employee Default Timesheet is split into six tabs: Summary, Earning Codes, Benefit Codes, Deduction Codes, Workers' Compensation Codes, and Leave Codes.

We recommend entering default timesheets for employees who have the same information week after week. The information entered on their default timesheet will automatically populate during timesheet entry, saving you time. Note that you can still make changes to an employee's individual timesheet when needed.

Select a tab to get started.

- Summary

- Earning Codes

- Benefit Codes

- Deduction Codes

- Workers' Compensation Codes

- Leave Codes

This tab displays a list of all payroll codes assigned to this employee's default timesheet, along with their values (whether it be a default number of hours entered for an earning code, or a default dollar amount deducted from their paycheck for a benefit code, etc.)

To make any changes to these values, select the corresponding tab on the default timesheet.

| Payroll Code | The type of code (see Payroll Codes). |

| Code |

The title of the code. |

| Calculation Method | The calculation method of the payroll code. |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Rate |

The payroll code's rate. |

| Amount | The amount entered as the default for this code on this employee's timesheet. |

| Distribution Code | The distribution code assigned to this payroll code. |

Use this tab to enter earning codes for the employee's default timesheet.

Note: You must also specify the appropriate Distribution Code for each Earning Code entered on this timesheet.

| Code |

The title of the code. |

| Calculation Method | The calculation method of the payroll code. |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Rate |

The payroll code's rate. |

| Amount | The amount entered as the default for this code on this employee's timesheet. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Earning Codes

If you enter an earning code that uses the "Amount on Timesheet" calculation method, you must enter a fixed amount.

If you enter an earning code that uses the "Rate on Timesheet" calculation method, you must enter a rate.

If you enter an earning code that uses the "Rate Multiplier", "Fixed Hourly Amount", "Employee Pay Rate", or "Rate on Timesheet" calculation methods, you must enter a number of hours.

See Payroll Earning Codes for more information on earning codes.

Use this tab to enter benefit codes for the employee's default timesheet.

| Code |

The title of the code. |

| Calculation Method | The calculation method of the payroll code. |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Rate |

The payroll code's rate. |

| Amount | The amount entered as the default for this code on this employee's timesheet. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Benefit Codes

If you enter a benefit code that uses the "Fixed Percentage of Earnings" or "Percentage on Timesheet" calculation methods, you must enter a percentage.

If you enter a benefit code that uses the "Fixed Hourly Amount" or "Fixed Amount" calculation methods, the system displays the amount that was entered for that benefit when you created the code.

If you enter a benefit code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Benefit Codes for more information on benefit codes.

Use this tab to enter deduction codes for the employee's default timesheet.

| Code |

The title of the code. |

| Calculation Method | The calculation method of the payroll code. |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Rate |

The payroll code's rate. |

| Amount | The amount entered as the default for this code on this employee's timesheet. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Deduction Codes

If you enter a deduction code that uses the "Fixed Percentage of Earnings" or "Percentage on Timesheet" calculation methods, you must enter a percentage.

If you enter a deduction code that uses the "Fixed Hourly Amount" or "Fixed Amount" calculation methods, the system displays the amount that was entered for that benefit when you created the code.

If you enter a deduction code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Deduction Codes for more information on deduction codes.

Use this tab to enter workers' compensation codes for the employee's default timesheet.

| Code |

The title of the code. |

| Calculation Method | The calculation method of the payroll code. |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Rate |

The payroll code's rate. |

| Amount | The amount entered as the default for this code on this employee's timesheet. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Workers' Comp Codes

If you enter a workers' compensation code that uses the "Rate per Workers' Compensation Hours calculation method, you must enter the amount of hours to use for the calculation.

If you enter a workers' compensation code that uses the "Rate per Hours Worked" or "Rate per $100 Earnings" calculation methods, the system automatically calculates the amount based on the rate entered when the code was created

See Payroll Workers' Compensation Codes for more information on workers' compensation codes.

Use this tab to enter leave codes for the employee's default timesheet.

| Code |

The title of the code. |

| Calculation Method | The calculation method of the payroll code. |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Rate |

The payroll code's rate. |

| Amount | The amount entered as the default for this code on this employee's timesheet. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Leave Codes

If you enter a leave code that uses the "Percentage on Timesheet" calculation method, you must enter a percentage.

If you enter a leave code that uses the "Amount on Timesheet" calculation method, enter that amount.

Note: "Beginning Balance" is calculated using the system date.