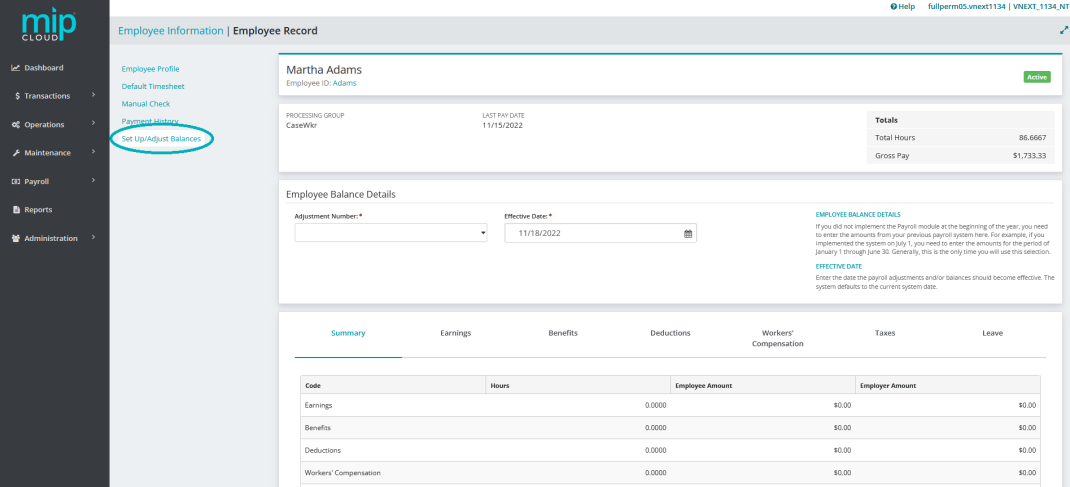

Set Up and Adjust Employee Balances

Use this form to enter year-to-date pay amounts from a previous payroll system, before your organization implemented MIP.

Note: Before making any adjustments, please note the following:

If you use the tabs on this form to change the amounts of any earnings, benefits, or deductions that have been used in the calculation of any federal, state, or other withholding taxes; or workers' compensation; the related tax and/or workers' compensation amounts may be incorrect.

Any changes you make to earnings may affect benefits, deductions, and leave. Therefore, you must manually adjust taxes, workers' compensation, benefits, deductions, and/or leave for any such changes you make.

If you do manually adjust either taxes or workers' compensation amounts, remember to also adjust the related subject earnings and/or hours.

Adjustments cannot be transferred to Accounting. Remember to separately record these transactions in Accounting, if needed.

You must enter amounts for the period of January 1 through the last day before your organization implemented MIP. For example, if you implemented MIP on July 1, you need to enter the amounts for the period of January 1 through June 30.

Once adjustments are saved, changes cannot be made to the adjustments and they cannot be deleted. A new adjustment must be entered to correct or change a previously saved one; you cannot edit it directly.

This form does not create any accounting entries. The amounts you enter are used by the payroll module only for reporting purposes and as a starting place to calculate payroll amounts and taxes.

Employee Balance Details

Adjustment Number: Enter an adjustment number for each adjustment.

The Adjustment Number can be used as an audit trail for your adjustments. For maximum benefit, note the Adjustment Number on the source document you use to determine the adjustment amounts. That way, you can trace adjustments back to their source. The adjustment number is a required entry that must be unique to each employee record.

Effective Date: Enter the date the payroll adjustments and/or balances should become effective. The system defaults to the current system date.

The proper Effective Date is determined by your implementation schedule and your reporting needs. If you are implementing any time after the beginning of the second quarter, you need to decide what reporting information is needed later in the year.

For instance, if you have taxes for which you want to see quarterly reports that include the first quarter as a separate amount, make a separate adjustment to specify those tax amounts for the first quarter, and use an Effective Date within the first quarter for that adjustment.

You also need a separate adjustment for each quarter of the calendar year before you implement. If, however, you can get quarterly reports from your previous payroll system, you can enter a single adjustment for the tax amounts to make the system current, using the implementation date as the Effective Date.

Set Up/Adjust Balances Table

- Summary

- Earnings

- Benefits

- Deductions

- Workers' Compensation

- Taxes

- Leave

This tab displays a list of all payroll codes assigned to this employee's adjustment, along with their values (whether it be a default number of hours entered for an earning code, or a default dollar amount deducted from their paycheck for a benefit code, etc.)

To make any changes to these values, select the corresponding tab on the adjustment table.

| Payroll Code | The type of code (see Payroll Codes). |

| Hours |

The amount of hours entered for this adjustment. |

| Employee Amount | The sum of all the earnings, deductions, taxes, etc, that were entered for the employee - including any earning codes that are "Contribute to Net Pay Only". |

| Employer Amount | The sum of all the workers' compensation, taxes, etc, that were entered for the employer. |

Use this tab to enter earning codes for this adjustment.

| Code |

The name of the code. |

| Title | The description of the code. |

| Hours |

The amount of hours entered for this adjustment. |

| Amount | The amount entered for this adjustment. |

Entering Earning Codes

If you enter an earning code that uses the "Amount on Timesheet" calculation method, you must enter a fixed amount.

If you enter an earning code that uses the "Rate on Timesheet" calculation method, you must enter a rate.

If you enter an earning code that uses the "Rate Multiplier", "Fixed Hourly Amount", "Employee Pay Rate", or "Rate on Timesheet" calculation methods, you must enter a number of hours.

See Payroll Earning Codes for more information on earning codes.

Use this tab to enter benefit codes for this adjustment.

| Code |

The name of the code. |

| Title | The description of the code. |

| Amount | The amount entered for this adjustment. |

Entering Benefit Codes

If you enter a benefit code that uses the "Fixed Percentage of Earnings" or "Percentage on Timesheet" calculation methods, you must enter a percentage.

If you enter a benefit code that uses the "Fixed Hourly Amount" or "Fixed Amount" calculation methods, the system displays the amount that was entered for that benefit when you created the code.

If you enter a benefit code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Benefit Codes for more information on benefit codes.

Use this tab to enter deduction codes for this adjustment.

| Code |

The name of the code. |

| Title | The description of the code. |

| Amount | The amount entered for this adjustment. |

Entering Deduction Codes

If you enter a deduction code that uses the "Fixed Percentage of Earnings" or "Percentage on Timesheet" calculation methods, you must enter a percentage.

If you enter a deduction code that uses the "Fixed Hourly Amount" or "Fixed Amount" calculation methods, the system displays the amount that was entered for that benefit when you created the code.

If you enter a deduction code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Deduction Codes for more information on deduction codes.

Use this tab to enter workers' compensation codes for this adjustment. You need to enter either "Hours" or "Subject Earnings" according to how the Workers' Compensation codes were set up (see Payroll Workers' Compensation Codes).

Note: If you use the tabs on this form to change the amounts of any earnings, benefits, or deductions that have been used in the calculation of any federal, state, or other withholding taxes; or workers' compensation; the related tax and/or workers' compensation amounts may be incorrect. Furthermore, be aware that any changes you make to earnings may affect benefits, deductions, and leave. Therefore, you must manually adjust taxes, workers' compensation, benefits, deductions, and/or leave for any such changes you make. If you do manually adjust either taxes or workers' compensation amounts, remember to also adjust the related subject earnings and/or hours.

| Code |

The type of workers' compensation code. |

| Title | The description of the code. |

| Hours |

The amount of hours the employee earned under this code, if applicable. |

| Subject Earnings |

The amount of earnings subject to workers' compensation calculations, if applicable. |

| Amount | Enter an amount here. |

Entering Workers' Comp Codes

If you enter a workers' compensation code that uses the "Rate per Workers' Compensation Hours calculation method, you must enter the amount of hours to use for the calculation.

If you enter a workers' compensation code that uses the "Rate per Hours Worked" or "Rate per $100 Earnings" calculation methods, the system automatically calculates the amount based on the rate entered when the code was created

See Payroll Workers' Compensation Codes for more information on workers' compensation codes.

Use this tab to enter taxes for this adjustment. Tax amounts set up here also appear on tax reports.

| Tax Type |

The tax type (see table below). |

| Jurisdiction | The jurisdiction that applies to the tax type, if applicable. |

| SUTA Weeks |

Enter the amount of SUTA weeks to calculate for this adjustment, if applicable. |

| Employee Subject Earnings |

Enter the employee's subject earnings. |

| Employer Subject Earnings | Enter the employer's subject earnings. |

|

Gross Taxable Earnings |

Enter the earnings (regardless of maximums) that are subject to the designated tax type. |

| Employee Amount | Enter the employee-paid amount for this adjustment. |

|

Employer Amount |

Enter the employer-paid amount for this adjustment. |

Entering Taxes

The table below lists the available tax types and whether they require a jurisdiction assignment. See Payroll Taxes for more information on tax codes.

| Code | Name | Jurisdiction Required? |

| FIT | Federal Income Tax | No |

| SS | Social Security Taxes | No |

| MC | Medicare Taxes | No |

| FUTA | Federal Unemployment Tax | No |

| SWT | State Withholding Taxes | Yes |

| SUTA | State Unemployment Taxes | Yes |

| LWT | Other Taxes (Employee-Paid Taxes) | Yes |

| LER | Other Taxes (Employer-Paid Taxes) | Yes |

Note: If you use the tabs on this form to change the amounts of any earnings, benefits, or deductions that have been used in the calculation of any federal, state, or other withholding taxes; or workers' compensation; the related tax and/or workers' compensation amounts may be incorrect. Furthermore, be aware that any changes you make to earnings may affect benefits, deductions, and leave. Therefore, you must manually adjust taxes, workers' compensation, benefits, deductions, and/or leave for any such changes you make. If you do manually adjust either taxes or workers' compensation amounts, remember to also adjust the related subject earnings and/or hours.

Entering Taxes

For more information on taxes, see Payroll Taxes.

Use this tab to enter adjustments to leave amounts for an employee.

| Code |

The type of leave code. |

| Title | The description of the code. |

| Hours Accrued |

The leave hours accrued on this adjustment. |

| Hours Taken |

The leave hours taken on this adjustment. |

Entering Leave

If you enter a leave code that uses the "Percentage on Timesheet" calculation method, you must enter a percentage.

If you enter a leave code that uses the "Amount on Timesheet" calculation method, enter that amount.

For more information on taxes, see Payroll Leave Codes.

Leave Example

Maximum Annual Accrual (Hours) is on an annual basis, not a total accrual basis. For example:

Let's say you are implementing payroll for the first time on 9/1/22. You enter a Leave code with a "Maximum Annual Accrual" of 80 because you do not want your employees to accrue more than 80 hours of leave per year.

In the case of Employee X, you do not need to enter a payroll check history, but you do need to enter Employee X's correct leave balance as of 9/1/22. Employee X has a leave balance of 32 hours from 2014; he has also accrued 53 hours so far in 2022 (for a total accrual of 85 hours).

In this case, you must make two leave adjustment entries for this employee: one for 32 hours (on the Leave tab) with an effective date of 12/31/21, and another for 53 hours (on the Leave tab) with an effective date of 8/31/22 (on the Select tab).

You should only enter one adjustment of 85 hours with an effective date of 8/31/22, because the system treats that as more than 80 hours of leave accrual for 2022 and makes adjustments accordingly the next time you calculate payroll.

Frequently asked questions about setting up and adjusting employee balances

If you implement the Payroll module mid-year, and you want to produce reports for previous quarters that include earnings, enter a separate adjustment for earnings for each quarter using an Effective Date within that quarter.

If, however, you are implementing mid-year and you do not need previous quarterly reports that include earnings, you can enter a single adjustment using the implementation date as the Effective Date. Enter the effective date in the Employee Balance Details section of this form.