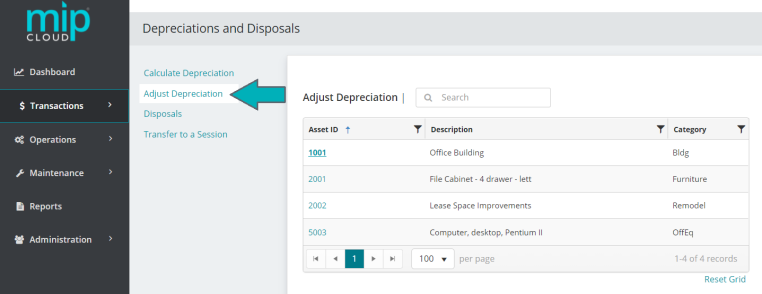

Adjusting Depreciation

Use this form to make an entry for adjusted depreciation to an asset.

Click the Asset ID that you’d like to work with to open the Adjust Posted Depreciation window.

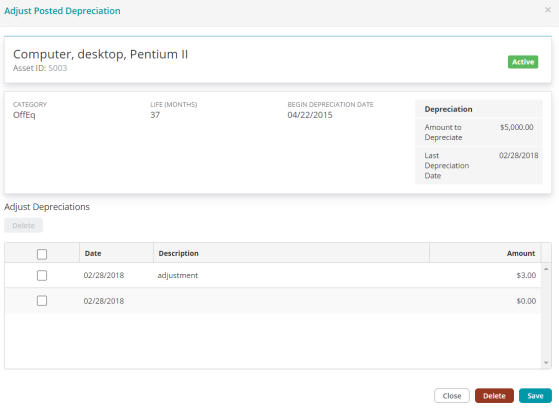

The Adjust Posted Depreciation window displays an asset's details such as the Amount to Depreciate, Begin Depreciation Date, Last Depreciation Date, and Life (Months).

The Adjust Depreciations grid only displays depreciation calculations that have not yet been posted - these entries can only be deleted, not adjusted.

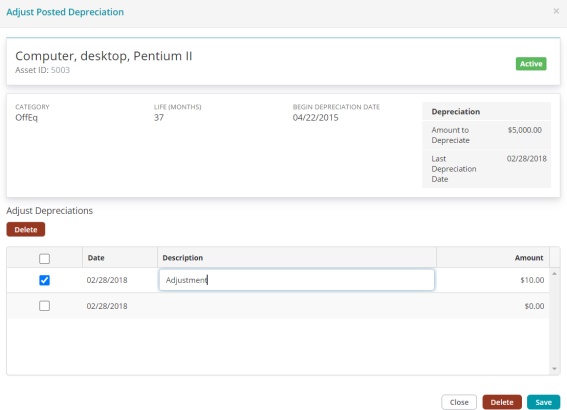

To make an adjustment to a posted depreciation entry, go to the last line of the Adjust Depreciations grid.

Enter an adjustment to the asset’s depreciation in this grid. The fields in this line are blank, except for the date.

Enter a description for the adjustment, and the amount to adjust by. The date is auto-populated to the date of the last posted depreciation.

Note: You can only make adjustments to posted depreciations. You cannot enter a depreciation adjustment to an asset if the asset does not have at least one posted depreciation calculation.

Note: You can also use this form to make adjustments to an asset's depreciation when the asset has been fully or partially disposed.

After entering your adjustments, click  .

.

Continue to Disposals to add disposal entries to this session, or go straight to Transferring to a Session if you're ready to post your changes.

The left menu is arranged in the suggest order of entries for depreciations and disposals.

Consider the following when working with the Adjust Depreciation form:

When entering adjustments for Calculated Depreciation or Adjusted Depreciation, you cannot enter a future date because the date cannot be greater than the Last Depreciation Date.

You can delete Calculated Depreciation and Disposed Depreciation, but you cannot edit them. If you delete either of these depreciations, any depreciation set for a future date is also deleted. because the deleted item was used in a calculation for the future depreciation.

Adjustments cannot be entered when there are Disposed Depreciation items that have not been transferred for an asset.

Depreciation adjustments cannot be made to assets with a depreciation code of "NO", or assets with the Zero Book Value check box selected, as there is not a depreciation for them.