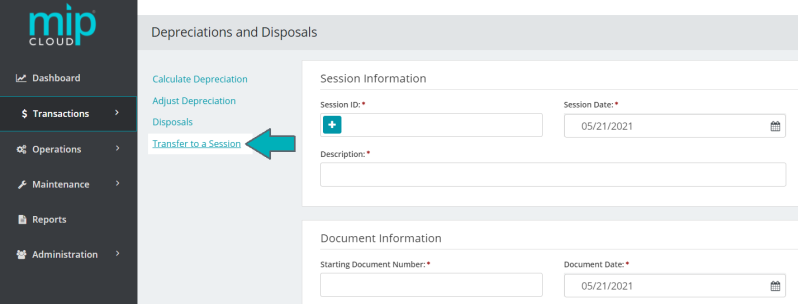

Transferring to a Session

Use this form to include your calculated depreciation, adjusted deprecation, disposed depreciation, and asset disposals into a session to be posted to the general ledger. Your entries will be posted immediately after transferring the session.

Fill out the fields on the form. See below for more information on each section of the form and its fields.

Session Information

|

Session ID |

Enter a unique session ID |

|

Session Date |

Enter a valid session date |

|

Description |

Enter a description for the session |

Document Information

|

Starting Document Number |

Enter a starting document number. This is the first document used for the transaction entries generated. The number of documents generated is determined by the Transfer Type (below) |

|

Document Date |

Enter a valid document date - this date serves as the effective date for the transaction entries |

|

Description |

Enter a description for the document |

|

Transfer Type |

This option will determine the way the session and documents are saved.

|

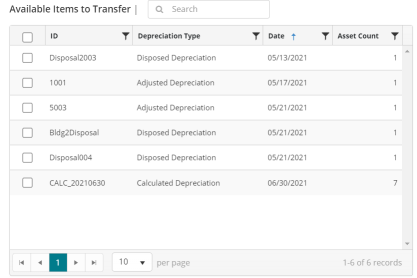

After filling out the fields above, select the entries you'd like to transfer from the Available Items to Transfer grid.

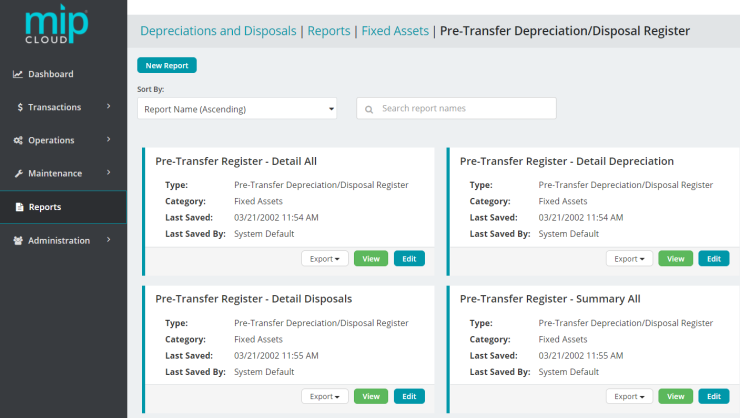

We recommend generating a Pre-Transfer Depreciation/Disposal Register report to ensure your entries are accurate before transferring them to the general ledger. Certain actions, such as disposals, cannot be undone once transferred. To generate the report, click  .

.

Note: This step is not required - if you're ready to transfer your entries without review, click the  button at the bottom of the page. If not, proceed as outlined below.

button at the bottom of the page. If not, proceed as outlined below.

Click the Depreciations and Disposals link at the top of this window to return to the Transfer to a Session page.

Your entries will be saved while you review the report. No entries will be transferred until you click  on the Transfer to a Session page.

on the Transfer to a Session page.

To proceed with the transfer, click the Depreciations and Disposals breadcrumb link at the top of the window, then click  . Transferring the session will immediately post all calculations to your general ledger.

. Transferring the session will immediately post all calculations to your general ledger.

Transferring the session creates JVD (Journal Voucher Depreciation/Disposal) transaction entries and posts them.

When you transfer a session, the system automatically updates the individual asset's profile pages to reflect updated depreciation, last depreciation date, and any other relevant fields (go to Managing Current Assets to see all the fields in an asset's profile page).

A disposed asset's profile page will be updated to reflect its new "Disposed" status, along with updated Cost, Salvage, Amount to Depreciate, Accumulated Depreciation, and Life values.

Note: When you close a fiscal year, you will not be able to depreciate assets that have a Last Depreciation Date within that fiscal year. In addition, if the asset has a status of Discontinued/Disposed, it cannot be changed after the year is closed.

Common questions about transferring fixed asset entries to the general ledger

An asset's type is what determines its accounting entries (see Asset Types). Asset types include the following transaction coding:

- The fixed asset general ledger account (used for disposals)

- The accumulated depreciation general ledger account (used for all types of depreciation entries)

- The depreciation expense general ledger account (used for depreciation entries)

- The distribution code

These accounting entries are posted to the general ledger when you transfer a session.

The Fixed Assets module is not a true subledger because entries can be made to your fixed asset general ledger accounts from any transaction source. In addition, assets added to the system are not checked to ensure they were booked to the General Ledger.

For that reason, we recommend periodically reconciling your asset inventory in the Fixed Assets module with the general ledger fixed asset accounts to ensure they agree.

To do this reconciliation, compare the Assets List Report to your Standard General Ledger Reports or Expanded General Ledger Reports fixed asset accounts.