Manual Check

Use this form to enter information for a paycheck you issued to this employee if the check that was not generated using MIP.

After entering a manual check, you can transfer it to Accounting (Payroll>Sessions>Transfer to Accounting).

Note: The system will not calculate any amounts on this form, including taxes. You must calculate and enter, on each tab, the amounts necessary to record the check information.

Note the following about entering manual checks:

Manual checks can have a zero balance, but they must have at least one earning code associated with it.

You cannot adjust leave balances with a manual check. To adjust an employee's leave balances, go to Payroll>System Setup>Employee Information, select an employee, then go to Set Up/Adjust Balances in the employee's profile. See Set Up and Adjust Employee Balances for more information.

Note: You can also choose to enter a supplemental timesheet (Add Timesheets) instead of writing a manual check. When you enter a supplemental timesheet and process a supplemental payroll, the system calculates the amounts required for you, and you can print the check.

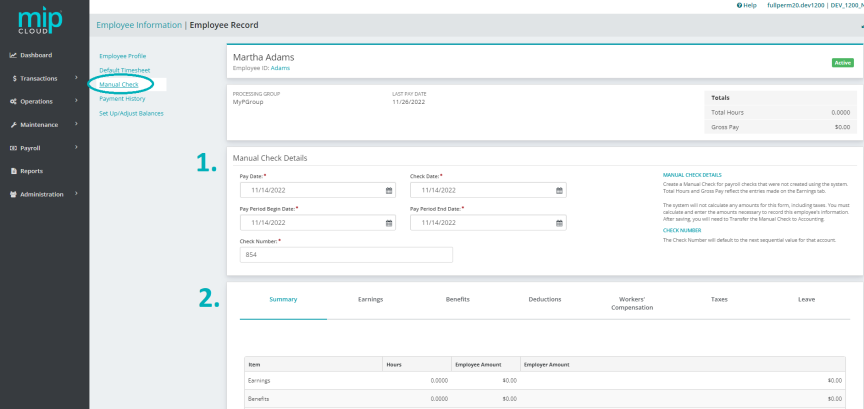

The manual check form is split into two sections: Manual Check Details, and the Payroll codes section.

Manual Check Details

Fill out the fields in the first section of the form, as follows:

| Pay Date | Enter the pay date for the manual check. |

| Check Date | Enter the date for the manual check. |

| Pay Period Begin Date | Enter the pay period begin date. |

| Pay Period End Date | Enter the pay period end date. |

| Check Number |

Enter the check number. You can set the "Last Used Check Number" for general ledger-type cash accounts by going to Maintenance>General Ledger>Chart of Accounts and selecting the cash account you're using for manual checks. |

Enter Payroll Codes

- Summary

- Earning Codes

- Benefit Codes

- Deduction Codes

- Workers' Compensation Codes

- Taxes

- Leave Codes

This tab displays a list of all payroll codes associated with this manual check, along with their values.

To make any changes to these values, select the corresponding tab on the table.

| Item | The type of code (see Payroll Codes). |

| Hours |

The amount of hours entered as the default for this code on this employee's timesheet. |

| Employee Amount | The sum of all the earnings, deductions, taxes, etc, that were entered for the employee - including any earning codes that are "Contribute to Net Pay Only". |

| Employer Amount | The sum of all the workers' compensation, taxes, etc, that were entered for the employer. |

Use this tab to enter earning codes for the employee's manual check.

Note: You must also specify the appropriate Distribution Code for each Earning Code entered on this timesheet.

| Code |

The type of earning code. |

| Title | The title of the code. |

| Hours |

The amount of hours the employee earned under this code. |

| Rate |

The payroll code's rate. |

| Amount | Enter an amount here, if applicable. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Earning Codes

If you enter an earning code that uses the "Amount on Timesheet" calculation method, you must enter a fixed amount.

If you enter an earning code that uses the "Rate on Timesheet" calculation method, you must enter a rate.

If you enter an earning code that uses the "Rate Multiplier", "Fixed Hourly Amount", "Employee Pay Rate", or "Rate on Timesheet" calculation methods, you must enter a number of hours.

See Payroll Earning Codes for more information on earning codes.

Note: Earning Codes that are "Contribute to Net Pay Only" are calculated and displayed in the "Employer Amount" column of the Summary tab.

Use this tab to enter benefit codes for the employee's manual check.

| Code |

The type of benefit code. |

| Title | The title of the code. |

| Hours |

The amount of hours the employee earned under this code. |

| Rate |

The payroll code's rate. |

| Amount | Enter an amount here, if applicable. |

| Distribution Code | The distribution code assigned for this payroll code. |

Entering Benefit Codes

See Payroll Benefit Codes for more information on benefit codes.

Note: Unlike entering timesheets, the system does not automatically calculate any amounts on this tab. You must manually calculate and specify the amounts necessary.

Use this tab to enter deduction codes for the employee's manual check.

| Code |

The type of deduction code. |

| Title | The title of the code. |

| Hours |

The amount of hours the employee earned under this code. |

| Rate |

The payroll code's rate. |

| Amount | Enter an amount here, if applicable. |

Entering Deduction Codes

See Payroll Deduction Codes for more information on deduction codes.

Note: Unlike entering timesheets, the system does not automatically calculate any amounts on this tab. You must manually calculate and specify the amounts necessary.

Use this tab to enter workers' compensation codes for the employee's manual check.

| Code |

The type of workers' compensation code. |

| Title | The title of the code. |

| Hours |

The amount of hours the employee earned under this code. |

| Subject Earnings |

The amount of earnings subject to workers' compensation calculations. |

| Amount | Enter an amount here, if applicable. |

Entering Workers' Comp Codes

See Payroll Workers' Compensation Codes for more information on workers' compensation codes.

Note: Unlike entering timesheets, the system does not automatically calculate any amounts on this tab. You must manually calculate and specify the amounts necessary.

Use this tab to enter taxes for the employee's default timesheet.

| Tax Type |

The tax type (see table below). |

| Jurisdiction | The jurisdiction that applies to the tax type, if applicable. |

| SUTA Weeks |

Enter the amount of SUTA weeks to calculate for this manual check, if applicable. |

| Employee Subject Earnings |

Enter the employee's subject earnings. |

| Employer Subject Earnings | Enter the employer's subject earnings. |

| Employee Amount | Enter the employee-paid amount for this manual check. |

|

Employer Amount |

Enter the employer-paid amount for this manual check. |

Note: Unlike entering timesheets, the system does not automatically calculate any amounts on this tab. You must manually calculate and specify the amounts necessary.

Entering Taxes

The table below lists the available tax types and whether they require a jurisdiction assignment. See Payroll Taxes for more information on tax codes.

| Code | Name | Jurisdiction Required? |

| FIT | Federal Income Tax | No |

| SS | Social Security Taxes | No |

| MC | Medicare Taxes | No |

| FUTA | Federal Unemployment Tax | No |

| SWT | State Withholding Taxes | Yes |

| SUTA | State Unemployment Taxes | Yes |

| LWT | Other Taxes (Employee-Paid Taxes) | Yes |

| LER | Other Taxes (Employer-Paid Taxes) | Yes |

Use this tab to enter leave codes for the employee's manual check.

Note: You can enter leave information for the manual check for reference, but the system will not adjust leave balances when entering a manual check. To adjust an employee's leave balances, go to Payroll>System Setup>Employee Information, select an employee, then go to Set Up/Adjust Balances in the employee's profile. See Set Up and Adjust Employee Balances for more information.

| Code |

The leave code. |

| Title | The title of the leave code. |

| Hours Accrued |

The amount of leave (in hours) the employee accrued with this check. |

| Hours Taken |

The amount of leave (in hours) the employee used in this pay cycle, if applicable. |

Entering Leave Codes

See Payroll Leave Codes for more information on leave codes.

Note: Unlike entering timesheets, the system does not automatically calculate any amounts on this tab. You must manually calculate and specify the amounts necessary.

Frequently asked questions about manual checks

You can choose to enter a supplemental timesheet (Add Timesheets) instead of writing a manual check. When you enter a supplemental timesheet and process a supplemental payroll, the system calculates the amounts required for you, and you can print the check just as you would when running regular payroll.

If you choose to enter a manual check, the system will not calculate any amounts for you, including taxes. You must calculate those amounts manually, then enter the amounts in the form.

In addition, manual checks can have a zero balance, but they must have at least one earning code associated with the check.