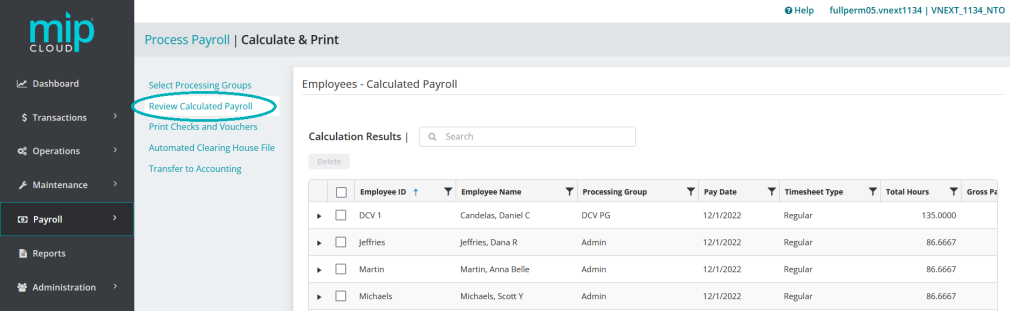

Review Calculated Payroll

Use this form to make changes to pay that was calculated for any employee.

Note: You can only make changes to a calculated payroll before printing checks. If you've already printed checks and need to make an adjustment, you must first void the check (see Void Payroll Checks), then run a supplemental payroll.

In MIP Cloud, you can make changes to an employee's calculated payroll directly in the table on this page. Click the dropdown arrow next to an employee's name to expand their payroll calculation. You can also delete a calculated payroll for an employee by selecting the checkbox next to their name and clicking  .

.

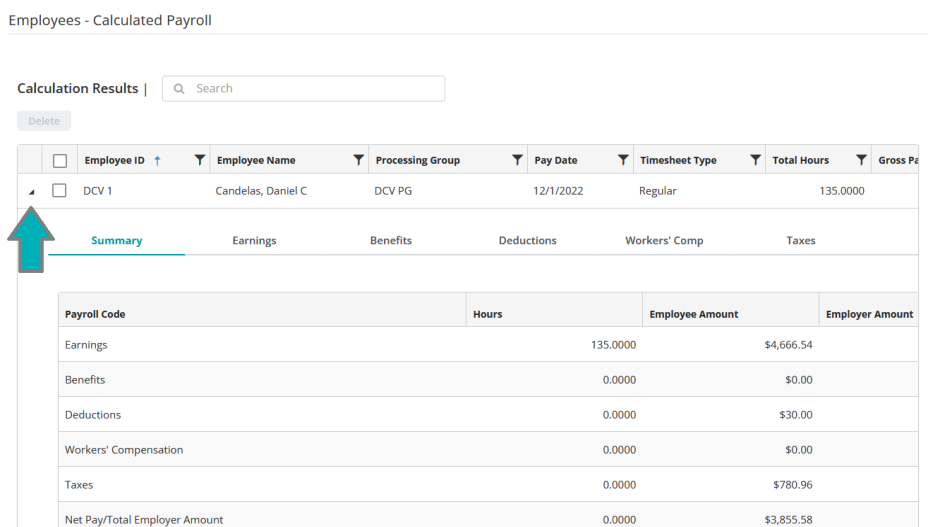

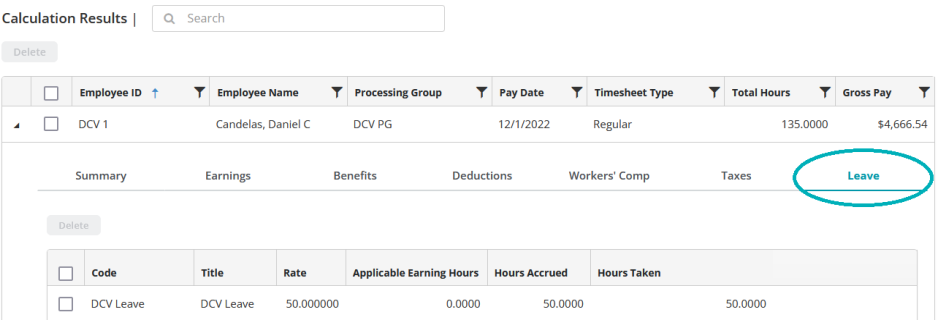

Click the arrow next to an employee's ID to expand that calculation.

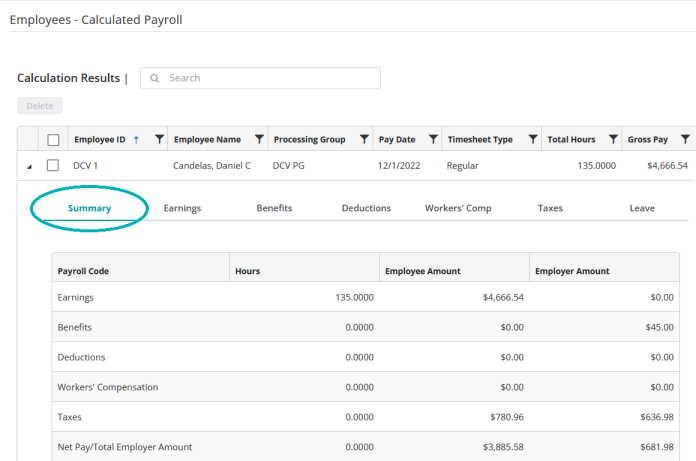

Select the tab you'd like to make changes to. You can make edits directly into the table - when you switch tabs or click  , the updated amounts will automatically calculate.

, the updated amounts will automatically calculate.

Note: When you save your changes by clicking the "Save" button, the system will ask if you want to recalculate. Select "Yes" to automatically recalculate any federal, state, or other taxes and related taxable subject earnings. If you select "No", you must manually adjust taxes, workers' compensation, benefits, deductions, leave, and any other related subject earnings.

For more information on each tab, click the tab's name below.

Selecting the "Summary" option from the toolbar will show a summary of the codes used to calculate an employee's paycheck.

If you need to make edits to the calculated payroll, select which codes to edit from Earnings, Benefits, Deductions, Workers' Comp, or Leave.

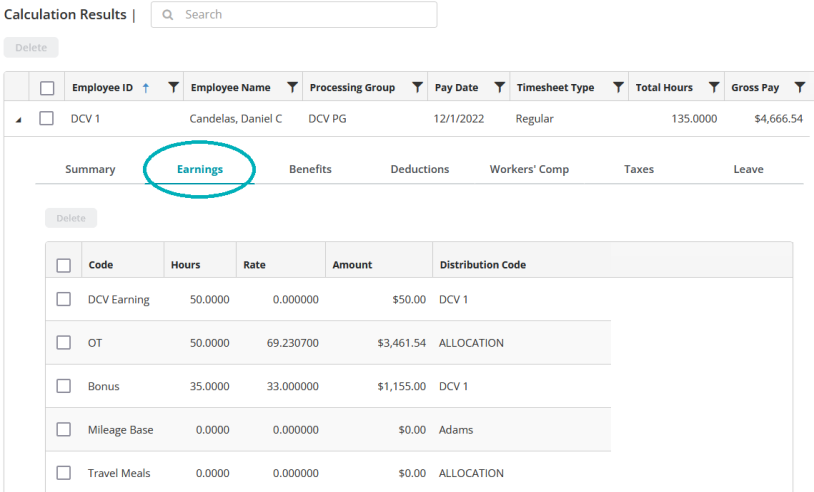

Select the "Earnings" option from the toolbar to view or make edits to the earning code entries calculated for an employee's paycheck.

If you previously created a default timesheet for an employee (see Employee Default Timesheet), that information will automatically populate for the employee's paycheck calculation.

Note: A distribution code is required for every earning code entry.

Entering Earning Codes

If you enter an earning code that uses the "Amount on Timesheet" calculation method, you must enter a fixed amount.

If you enter an earning code that uses the "Rate on Timesheet" calculation method, you must enter a rate.

If you enter an earning code that uses the "Rate Multiplier", "Fixed Hourly Amount", "Employee Pay Rate", or "Rate on Timesheet" calculation methods, you must enter a number of hours.

See Payroll Earning Codes for more information on earning codes.

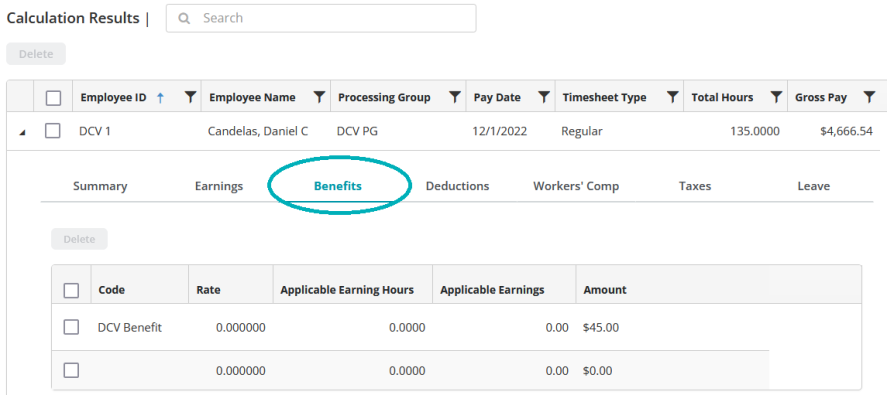

Select the "Benefits" option from the toolbar to view or make edits to the benefit code entries calculated for an employee's paycheck.

Note: If you previously created a default timesheet for an employee (see Employee Default Timesheet), that information will automatically populate for the employee's paycheck calculation. .

Entering Benefit Codes

If you enter a benefit code that uses the "Fixed Percentage of Earnings" or "Percentage on Timesheet" calculation methods, you must enter a percentage.

If you enter a benefit code that uses the "Fixed Hourly Amount" or "Fixed Amount" calculation methods, the system displays the amount that was entered for that benefit when you created the code.

If you enter a benefit code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Benefit Codes for more information on benefit codes.

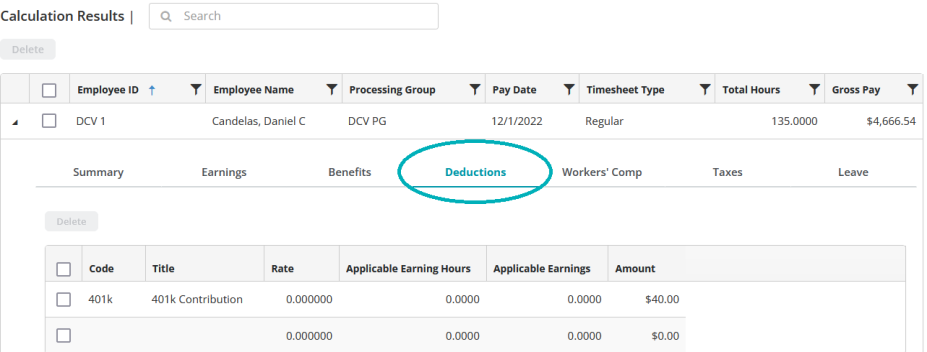

Select the "Deductions" option from the toolbar to view or make edits to the deduction code entries calculated for an employee's paycheck.

Note: If you previously created a default timesheet for an employee (see Employee Default Timesheet), that information will automatically populate for the employee's paycheck calculation. .

Entering Deduction Codes

If you enter a deduction code that uses the "Fixed Percentage of Earnings" or "Percentage on Timesheet" calculation methods, you must enter a percentage.

If you enter a deduction code that uses the "Fixed Hourly Amount" or "Fixed Amount" calculation methods, the system displays the amount that was entered for that benefit when you created the code (see Payroll Deduction Codes).

If you enter a deduction code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Deduction Codes for more information on deduction codes.

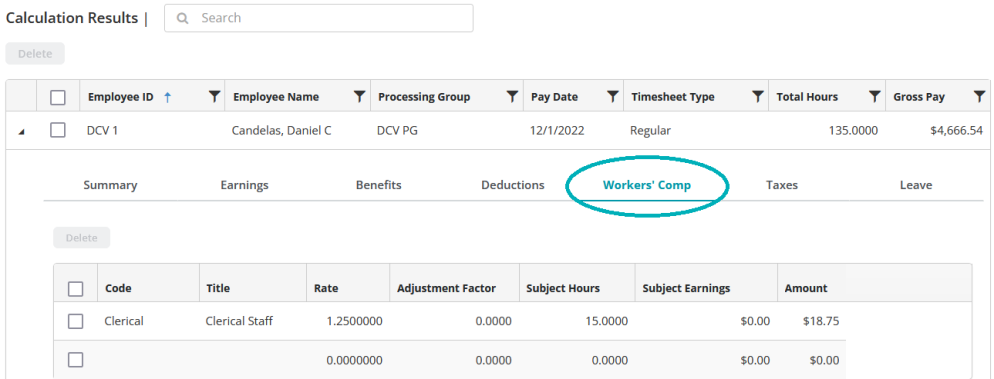

Select the "Workers' Comp" option from the toolbar to view or make edits to the workers' compensation code entries calculated for an employee's paycheck.

Note: If you previously created a default timesheet for an employee (see Employee Default Timesheet), that information will automatically populate for the employee's paycheck calculation. .

Entering Workers' Comp Codes

If you enter a workers' compensation code that uses the "Rate per Workers' Compensation Hours calculation method, you must enter the amount of hours to use for the calculation.

If you enter a workers' compensation code that uses the "Rate per Hours Worked" or "Rate per $100 Earnings" calculation methods, the system automatically calculates the amount based on the rate entered when the code was created.

See Payroll Workers' Compensation Codes for more information on workers' compensation codes.

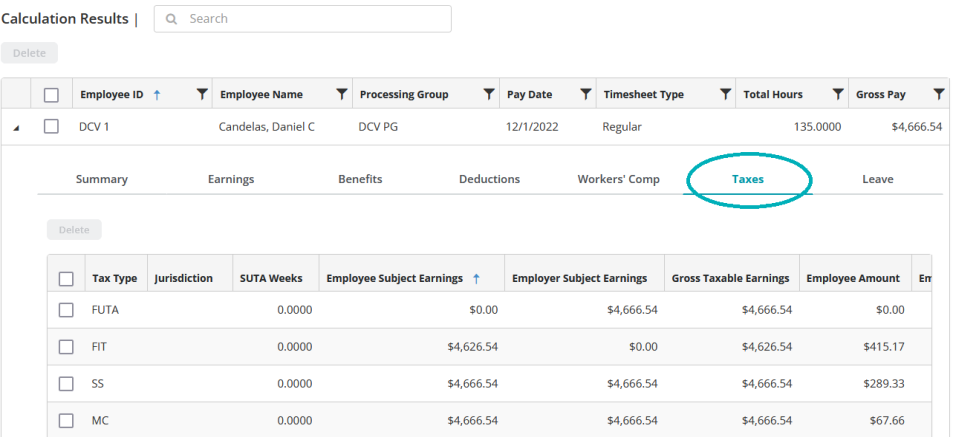

Use this tab to enter taxes calculated for an employee's paycheck.

| Tax Type |

The tax type (see table below). |

| Jurisdiction | The jurisdiction that applies to the tax type, if applicable. |

| SUTA Weeks |

Enter the amount of SUTA weeks to calculate for this manual check, if applicable. |

| Employee Subject Earnings |

Enter the employee's subject earnings. |

| Employer Subject Earnings | Enter the employer's subject earnings. |

| Employee Amount | Enter the employee-paid amount for this manual check. |

|

Employer Amount |

Enter the employer-paid amount for this manual check. |

Note: Taxes are not calculated for any Earnings Code with the "Contribute to Net Pay Only" checkbox selected (see Payroll Earning Codes).

Entering Taxes

The table below lists the available tax types and whether they require a jurisdiction assignment. See Payroll Taxes for more information on tax codes.

| Code | Name | Jurisdiction Required? |

| FIT | Federal Income Tax | No |

| SS | Social Security Taxes | No |

| MC | Medicare Taxes | No |

| FUTA | Federal Unemployment Tax | No |

| SWT | State Withholding Taxes | Yes |

| SUTA | State Unemployment Taxes | Yes |

| LWT | Other Taxes (Employee-Paid Taxes) | Yes |

| LER | Other Taxes (Employer-Paid Taxes) | Yes |

Select the "Leave" option from the toolbar to view or make edits to the leave code entries calculated for an employee's paycheck.

Note: If you previously created a default timesheet for an employee (see Employee Default Timesheet), that information will automatically populate for the employee's paycheck calculation. .

Entering Leave Codes

If you enter a leave code that uses the "Percentage on Timesheet" calculation method, you must enter a percentage.

If you enter a leave code that uses the "Amount on Timesheet" calculation method, enter that amount.

See Payroll Leave Codes for more information on leave codes.

Note: "Beginning Balance" is calculated using the system date.

When you are finished saving your changes, proceed to Print and Email Checks and Vouchers.

Common questions about reviewing calculated payroll in MIP Cloud

To reimburse an employee for a separate expense, create an Earning code with the "Contribute to Net Pay Only" checkbox selected (see Payroll Earning Codes). This will allow you to reimburse the employee the net pay amount without the amount being subject to taxes and fringe benefits.

At this time, MIP Cloud does not support garnishment calculations. Please calculate garnishments in the MIP Classic product.