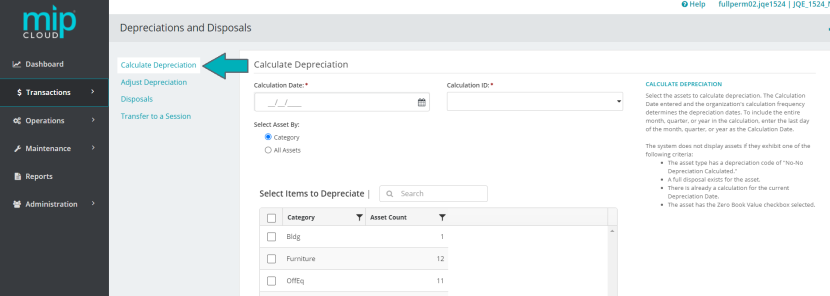

Calculating Depreciation

Use this form to calculate depreciation for assets. The system determines the depreciation dates for these calculations based on the Calculation Date and your organization’s calculation Frequency (the frequency entered when the Fixed Assets module was set up by your organization).

To include an entire month, quarter, or year in the calculation, you must enter the last day of the month, quarter, or year as the Calculation Date.

The system will not display an asset for depreciation calculation if any of the following apply:

-

The asset type has a depreciation code of “NO-No Depreciation Calculated”

-

A full disposal exists for the asset

-

The asset is being used in another calculation for the current Depreciation Date

-

The asset has the Zero Book Value check box selected

Note: If you make a change on this form or related forms (such as your Asset Types or Custom Depreciation Codes through the Maintenance tab) after the calculation process, you must re-calculate. This ensures that any changes made are reflected in the calculation.

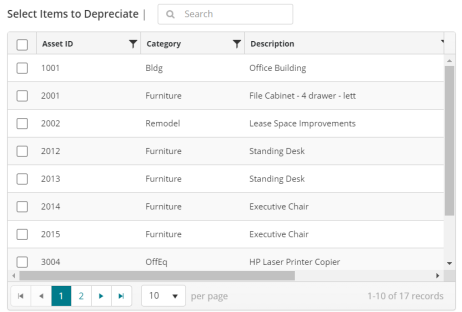

Fill out the fields on the form. See below for more information on each section of the form and its fields.

| Calculation Date | Enter a date for this calculation |

| Calculation ID | Enter an ID for this calculation, or use the system-generated ID |

| Select Assets By |

You can select assets by Category, or from a list of all your assets.

|

Select the items you'd like to depreciate, click  to run the calculation.

to run the calculation.

If the calculation was successful, the system will display a success prompt and return you to the Calculate Depreciation page.

Continue to Adjusting Depreciation or Disposals to add those entries to the current session, or go straight to Transferring to a Session if you're ready to post your changes.

The left menu is arranged in the suggest order of entries for depreciations and disposals.

Consider the following when working with the Calculate Depreciation form:

When you close a fiscal year, you will not be able to depreciate assets that have a Last Depreciation Date within that fiscal year. In addition, if the asset has a status of Discontinued/Disposed, it cannot be changed after the year is closed.

If you need to add Basis to an Active asset that is fully depreciated, you must create a new asset if the Last Depreciation Date for the asset is in a closed year. Depreciation cannot be transferred to a closed year.

When you calculate depreciation, you are crediting a contra account (accumulated depreciation) and debiting an expense account (depreciation expense).

Common questions about calculating depreciation in MIP Cloud

Click the drop-down links below for answers to common questions about calculating depreciation in MIP Cloud.

How does MIP Cloud work with dates when calculating depreciation?

-

Depreciation is calculated based on your organization’s Fiscal Year-End Date (found in Organization Settings). For example, if your organization’s Fiscal Year End-Date is 12/15, the system will depreciate the months as follows: 12/16-1/15, 1/16-2/15, and so on.

-

When you enter a Begin Depreciation Date, the indicated month is included in the depreciation calculation. If your Fiscal Year-End Date is 12/15, and you enter 2/22 as your Begin Depreciation Date, the system includes the depreciation for the dates of 2/16-3/15 in its calculation.

-

If, for example, you enter a Last Depreciation Date of 10/31 and the Fiscal Year-End Date in the system is 6/30, the system assumes you have included the depreciation for 10/31 through 11/30. It begins calculating depreciation for 12/1 through 12/30. If 2/28 or 2/29 is entered, the system begins calculating depreciation for 3/1 through 3/30.

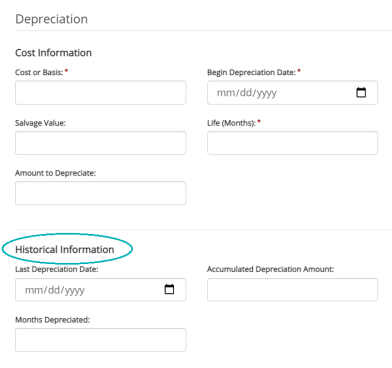

How do I add an asset that has already begun depreciation?

The process to add an asset with existing depreciation is the same as when adding newly acquired assets, with one extra step.

Example: My organization just switched to MIP Cloud as our fund accounting software. We have a printer that was purchased 3 years ago for $5,000. The printer has already depreciated by $1,200. How do I account for that prior depreciation when adding the asset?

When adding the asset, proceed through each of the sections as listed above.

When you reach the Depreciation section, fill the fields as described below. Note the Historical Information fields highlighted in blue for extra notes.

Cost or Basis: Enter the original cost or basis of the asset when first acquired

Begin Depreciation Date: The date the asset was acquired

Salvage Value: Enter the original salvage value, unless the value has been changed due to impairment

Life (Months): Enter the original Life, unless its life was reduced due to impairment

Amount to Depreciate: The Cost or Basis minus the Salvage Value

Last Depreciation Date: The date the asset was last depreciated before entered in the system

Accumulated Depreciation Amount: Enter the amount the asset has already depreciated by. You will have to manually calculate this amount, then enter it - the system will not calculate any depreciation that took place before the asset was added into MIP Cloud.

Months Depreciated: Enter the number of months the asset has already depreciated since you acquired the asset

After you save the asset entry, you must make a journal voucher entry (through Transactions>General Ledger>Journal Vouchers) to record the Accumulated Depreciation Amount before the asset was added into MIP Cloud. From then on, the system will calculate the remaining depreciation.

What depreciation methods are available in the Fixed Assets module, and how do they calculate depreciation?

MIP Cloud includes five built-in standard depreciation methods. See below for detailed descriptions of how each of these methods calculate depreciation.

To create a custom depreciation code that uses a different depreciation method, see Custom Depreciation Codes.

Straight Line (SL): This is the simplest method of depreciation. It is calculated by taking the Cost minus the Salvage value, divided by the Useful Life of the asset. The depreciation expense is roughly the same amount for every frequency during the life of the asset. You may want to use this depreciation method when an asset's usefulness decreases evenly over the life of the asset. Straight Line is used as the Switch To Depreciation Code (Maintenance>Fixed Assets>Fixed Assets>Asset Types) when using an accelerated depreciation code.

Sum of the Years Digits (SYD): This method results in a decreasing depreciation charge based on a decreasing fraction of depreciable cost.

This is sometimes referred to as an accelerated depreciation method, because the depreciation expense is much higher in the beginning of the asset's life. You may want to use this depreciation method when the asset's usefulness decreases more rapidly at the beginning of the asset's life.

The fraction's denominator is calculated using the following formula:

(n(n+1))/2 = SYD denominator

"n" represents the number of years to be depreciated. If you want to depreciate something for 5 years, the SYD denominator would be 15. Therefore, the first year depreciation would be calculated using the remaining asset's life (in full years) of 5 years divided by the SYD of 15 (5/15=33.3333%). The second year is 5 years divided by 15 SYD equaling 26.6667%.

Declining Balance (DB150): This method is a decreasing charge method that uses 1 1/2 times the straight-line rate. This is sometimes referred to as an accelerated depreciation method because the depreciation expense is much higher in the beginning of the asset's life. You may want to use this depreciation method when the asset's usefulness decreases more rapidly at the beginning of the asset's life.

Declining Balance (DB200): This method is a decreasing charge method that uses 2 times the straight-line rate. This is sometimes referred to as an accelerated depreciation method because the depreciation expense is much higher in the beginning of the asset's life. You may want to use this depreciation method when the asset's usefulness decreases more rapidly at the beginning of the asset's life.

No Depreciation Calculated (NO): This method does not calculate any depreciation. If you select this method, you do not need to enter any information in the Expenditure or Accumulated Depreciation Account boxes when creating a new Asset Type on the Maintenance>Fixed Assets>Fixed Assets>Asset Types form.

An asset's type is what determines its accounting entries (see Asset Types). Asset types include the following transaction coding:

- The fixed asset general ledger account (used for disposals)

- The accumulated depreciation general ledger account (used for all types of depreciation entries)

- The depreciation expense general ledger account (used for depreciation entries)

- The distribution code

These accounting entries are posted to the general ledger when you transfer a session.