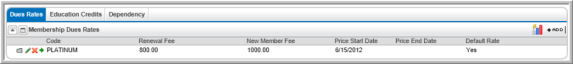

Dues Rates Calculation Parameters

are set-up on the Dues Rates Profile

of a Member Type under the default

Dues Rate. To access the Dues Rate profile, click the green

GoTo  arrow next to the default Dues Rate you set-up initially for the Member

Type, seen below.

arrow next to the default Dues Rate you set-up initially for the Member

Type, seen below.

For the purpose of this example, assume the Dues Rates to be calculated by the number of employees an organization has is based upon a range as follows:

- When number of employees is between 1 and 50, Dues Rate for the Member Type = $700.00

- When number of employees is between 51 and 100, Dues Rate for the Member Type = $800.00

- When number of employees is between 101 and 500, Dues Rate for the Member Type = $900.00

- When number of employees is between 500 and 10,000, Dues Rate for the Member Type = $1000.00.

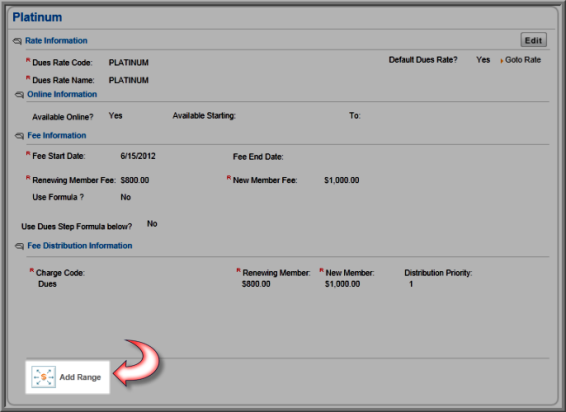

On the Dues Rate profile, begin adding the formulas

that calculate these Dues Rates in one of two ways; by clicking the

Add Range button on the Actions Bar or by clicking the Add  button

on the Dues Ranges tab, seen in

the image below.

button

on the Dues Ranges tab, seen in

the image below.

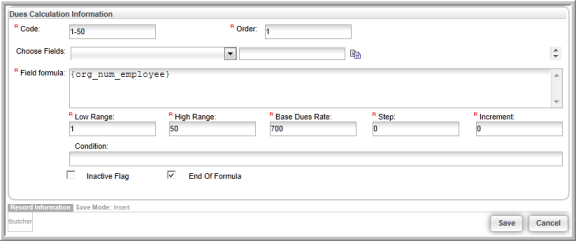

Clicking the Add Range or Add button will prompt a Dues Calculation Information window. Enter the Dues Rates calculation steps for the first 50 employees as seen in the image below.

When the Dues Calculation Information window appears, complete the required fields to enter the calculation as follows:

Code: An easily identifiable code for the Dues Rate, such as 1-50 for organizations that have between 1 and 50 employees.

Order: The order in which the dues will be calculated and displayed when the Membership is placed in a Shopping Cart.

Choose Fields: The fields needed in the calculations if not already obtained from the Data Import Workbook. Use the Data Import workbook to obtain required fields not available in this drop-down.

Field Formula: Use the Database Column in the Data Import workbook to obtain the field name needed in the calculated Dues Rates formula. In this case, use the number of employees database column; or {org_num_employee} entered in the Field Formula field to calculate a Dues Rates based on a range of employees (1 to 50).

Low Range / High Range: The Low Range and High Range fields are used to specify the lowest end of the range the Highest end of the range; in this case 1 and 50. To enter the next range for this example (number of employees between 51 and 100), a 51 would be entered in Low Range and a 100 would be entered in High Range.

Base Dues Rate: Enter the charge for this membership when the calculation is performed. In this example, organizations with 1 to 50 employees will be charged $700.00 for the membership.

Step: Specify to increment the Base Dues Rate by an amount specified in the Increment field when the demographic field being used is updated by a given amount, specified in the Step field. For example, for every X number of employees specified in the Step field, the Base Dues field will be ‘stepped’ or incremented by X amount specified in the Increment field. Step and Increment are used to dictate the amount charged for a membership is based on individual number of employees on an escalating scale, instead of charging a flat rate per range as used in this example. This is described more in Using Calculated Dues with Steps and Increments. This field is not used in this example, so a zero is entered.

Increment: Using the Increment field, specify to increment the Base Dues Rate by an amount specified in the Increment field when the demographic field being used is updated by a given amount as well, specified in the Step field. For example, for every X number of employees specified in the Step field, the Base Dues field will be ‘stepped’ or incremented by X amount specified in the Increment field. Step and Increment are used to dictate that the amount charged for a membership is based on individual number of employees on an escalating scale, for example, instead of charging a flat rate per range as used in this example. This is described more in Using Calculated Dues with Steps and Increments. This field is not used in this example, so a zero is entered.

Condition: Used to specify additional conditions to Dues Rates. For example, this Dues Rate is applied to organizations between 1 and 50 employees and residing in the United States only. This is also where the default Dues Rate is used. What if an organization outside of the United States attempts to purchase this membership? A parameter has not been set for this calculation (in this example); as a result, the default Dues Rate would be used. More on applying conditions is explained in the section Applying Additional Conditions to Your Dues Rate. For now, leave this field blank for the purposes of this example.

End of Formula: Make sure that the End of Formula check box is selected to indicate to netFORUM that the calculation is complete.

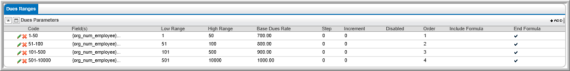

Given the example used, a new range will now need to be added for each range used for number of employees. When finished, the Dues Ranges tab will contain the Dues Parameters for each one, as seen below.

Each number of employees range is accounted for (by glancing at Code Name), the org_num_employee has been entered in the Field Formula field (with braces) and the Low and High Range for each is allocated along with what the organization will be charged for each employee as the Base Dues Rate when they fall into that range.

Optionally, set-up Dues Rate parameters using the Step and Increment methods or by using a Formula instead of the range method described in this topic. Regardless, once the Dues Parameters are complete, finalize usingDues Rate Profile Settings.

Note: Calculated Dues Rate can not be prorated.