Setting Up Late Fees

When an invoice/order is paid late or behind in payment, organizations often desire a means to assess late fees. As a result, the Late Fees product has been created for netFORUM. Using late fees, you may enact business processes to assess late fees on membership dues renewals, merchandise, events/session, exhibits/booths, or any product type that have outstanding invoices/orders where this may be applicable.

Note: Late fees may not be applied if the original invoice batch is closed.

You may choose to assess them by defining your own term limits such as 30-days late, 60-days late, year-end assessments and so forth. Finally, you may assess one person at a time or use a batch process to determine all invoices/orders that are 30 days late for example.

Late Fee Set-Up

Before you may assess late fees, you must first determine how your organization will use late fees and then use the Administration module for set-up. Late fees may be a flat rate or based on a percentage of the amount due.

To set-up a late fee, complete the following steps:

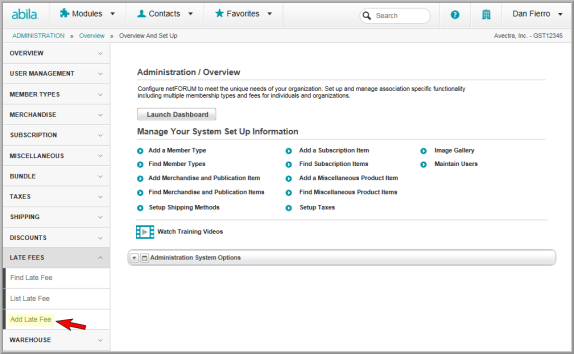

- Click the Administration hyperlink on the Module Menu to launch the Administration module.

- Click the Late Fees group item to display the list of available actions.

- Click the Add Late Fee link to open the Late Fee Product Information page.

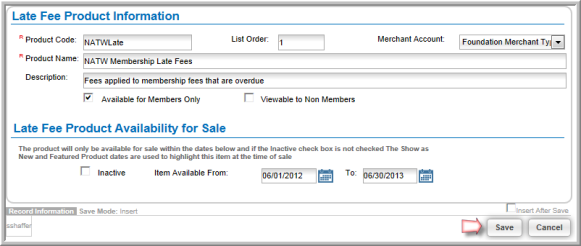

- Enter the code that will be used to identify the late fee in the netFORUM system in the Product Code field.

- Enter a numeric value in the List Order field. This number will signify the position in a list of late fees, this new fee will be listed.

- Expand the Merchant Account drop-down and choose the merchant account this late fee is to be associated with.

- Enter the name for the late fee in the Product Name field.

- Enter a short description of the late fee in the Description field.

- Click the Available for Members Only check box if this field only applies to members.

- Click the inactive check box if the late fee is no longer actively being used.

- Enter the dates this late fee is to be available in the Item Available From fields.

- Click the Save button.

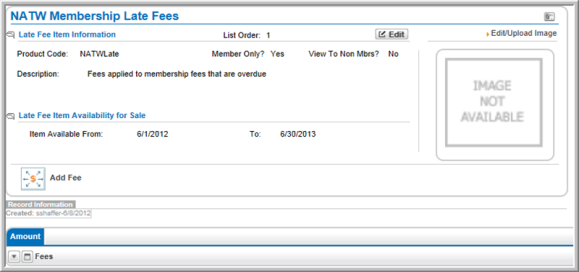

After saving the new late fee, you will be taken to the late fee profile. Here you may begin entering fee amounts. As mentioned, you may enter a flat rate or a percentage based fee - which is based on the amount due of the invoice.

Adding Fees to a Late Fee

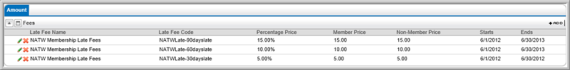

In the sample late fee, three different fees will be used, a 30- day, 60-day, and 90-day late fee assessment.

To add a fee to a Late Fee profile, complete the following steps:

- Click the Add Fee

icon on the action bar or the Add

button on the Fees

child form located on the Amount

tab.

button on the Fees

child form located on the Amount

tab. - Code: Enter a descriptive code for the Late Fee.

- Price Name: Enter a descriptive name for the Late Fee. This will appear in drop-down menus and on the invoice so it should accurately reflect what fee is being assessed.

- Charge Code: Expand the Charge Code drop-down menu and select the charge code this fee will be applied to.

- Member Cost/Non-Member Cost: You may choose to assess different fees based on member or non-member. This is a flat rate.

- Percentage: You may also assess by percentage. If you choose to assess by percentage instead of flat fee, the percentage is based on the Balance Due of the product/line item in the order/invoice. Note that balance due may reflect a line item for membership, product, etc. and include tax and shipping for that line item.

- Start Date/End Date: Enter the start date and end dates when the fee is available for use.

Tip:

If you choose to enter both a flat fee and a percentage rate during late fee set-up, the percentage will be the fee used when you run the batch process to assess multiple late fees. Only the flat fee will be assessed when processing one late fee at a time through the iWeb shopping cart.

- Click the Save button. Once saved, your fee will appear in the Fees child form under the Amount tab. In the example below, three fees have been added.