You are here: netFORUM Pro Modules > Administration > Online Store Setup > Setting up Country Tax Information

Setting up Country Tax Information

You can set up country tax so that a tax amount will automatically be added to the total purchase price for a product during Check Out (based on the country, province or territory the item is being shipped to).

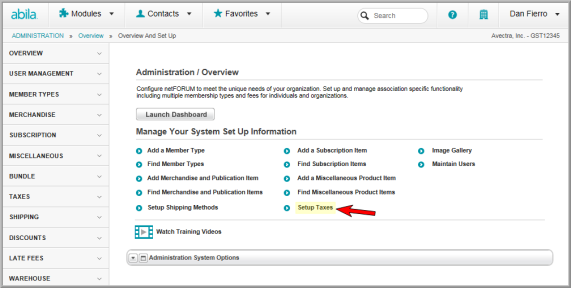

- Hover over the Modules tab in the top navigation bar. In the fly out menu, click Administration. The Administration/Overview page will appear.

- Click Set Up Taxes.

- On the Tax Information page, select the country from the Country drop-down list.

- Select the province or territory from the State/Province drop-down list.

If you select the Tax Inactive check box, tax will not be added to the orders or invoices for customers with a billing address in the selected province or territory.

- Enter the Tax Percentage. (If the tax is 5 percent, enter 5 in the Tax Percentage field.)

- Select the Charge Code for tax tracking.

- Click Save.

This creates the Tax Information Profile.

When a customer shops online, tax is added during the Shipping Method & Tax Options step.