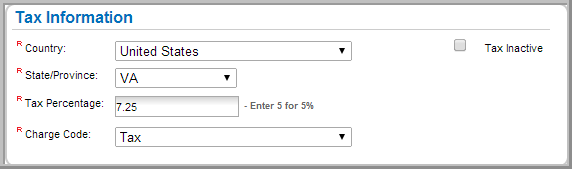

Setting up Tax Information

Set up state tax rates so that a tax amount will automatically be added to the total purchase of a product during Check Out (based on the state to which the item is being shipped).

- On the Tax Information page, select the State.

- Enter the Tax Percentage. (If the tax is 5 percent, enter 5 in the tax percentage field.)

- Select Tax for the Charge Code.

- Click Save. This creates the Tax Information Profile.

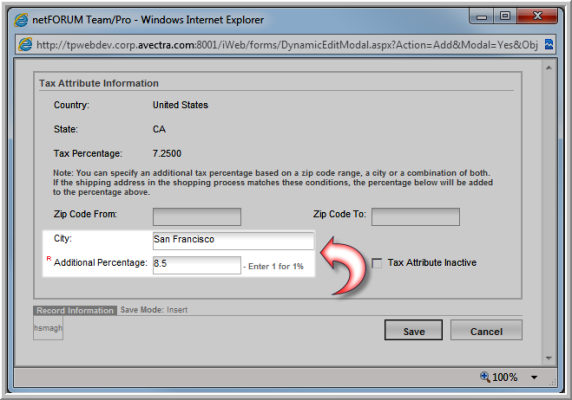

To add an additional city tax:

- Navigate to the Tax Information Profile.

- On the Tax Attributes child form, click Add.

- In the Tax Attribute Information window, enter the City.

- Enter the Additional Percentage.

- Click Save.

The city tax displays on the Tax Attributes child form.

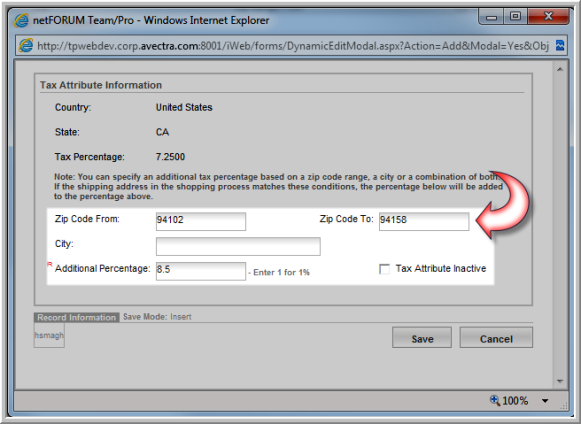

To add additional tax based on zip code:

- On the Tax Attributes child form, click Add.

- In the Tax Attribute Information window, enter the zip code range in the Zip Code From and Zip Code To fields.

- Enter the Additional Percentage.

- Click Save.

The tax by zip code displays on the Tax Attributes child form.