Canadian users of netFORUM Pro require the ability to be able to track taxes on all of their products. These products include events, memberships, and all other products that are sold. Note, this system option must be enabled by support or an account manager.

In addition to the requirement to be able to track all taxes, Canada has specific tax rules for types of products being sold. These guidelines are as follows:

- Events: Taxes are applied based on the location of the event. All events must specify the country and province where the event is being held for the tax to be calculated.

- Memberships, Certifications, Donations, and Miscellaneous Items: Taxes are applied based on the member’s province. This location must be a home address.

- Merchandise Products: Taxes are applied based on the province of the shipping address.

If a member/customer works for the government and should not be taxed, the current tax exempt functionality should be used. For more information on applying tax exemptions, visit the Applying Tax Exemptions online help topic.

State/Province Tax Setup

Before the VAT tax calculations can be applied, the various tax rates for Canada’s provinces must be set up.

Note: You must have the EnableVATTax system option enabled to use this feature.

To set up the taxes for the individual provinces in Canada, complete the following steps:

- Launch netFORUM Pro.

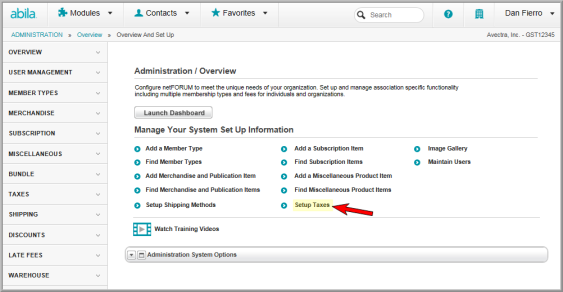

- Click the Administration hyperlink located on the Module Menu. This will open the Administration / Overview page.

- Click the Set Up Taxes hyperlink located on the Administration / Overview page.

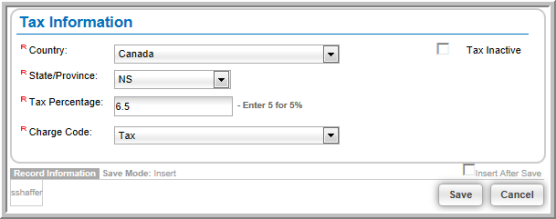

- Select Canada from the Country drop-down menu. This will populate the State/Province drop-down menu with a list of Canadian provinces.

- Select the province you wish to create the VAT tax for from the State/Province drop-down menu.

- Enter the tax rate in the Tax Percentage field. For example, enter ”6.5” for a tax rate of 6.5 percent.

- Select the charge code for this tax from the Charge Code drop-down menu.

- Click the Save button.

Once the VAT tax is setup and the system option is enabled, the VAT tax will be available for calculation during the checkout procedure when purchasing event registrations, memberships, certifications, and other netFORUM products. However, each of those products must be setup to have taxes applied during purchase.