Applying Tax Exemptions

If an organization is exempt from paying taxes (i.e., the Tax Exempt flag is selected on the Customer Profile), when the customer makes a purchase that would normally have a tax associated with it, the tax will be removed during the iWeb Shopping Cart or eWeb Online Store Check Out process.

To set up the Tax Exempt Demographic fields:

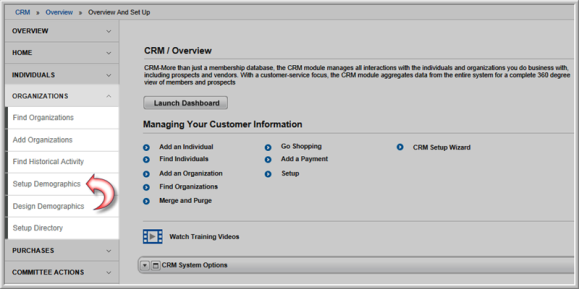

- Click the CRM hyperlink on the Module Menu to launch the CRM module.

- Click the Organization group item to display the available actions.

- Click the Setup Demographics hyperlink.

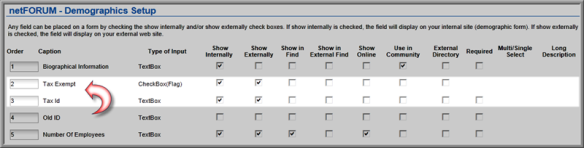

- In the Demographics Setup window, select the appropriate Tax Exempt and Tax ID check boxes.

- Click the Save button.

To record that a customer has Tax Exempt status:

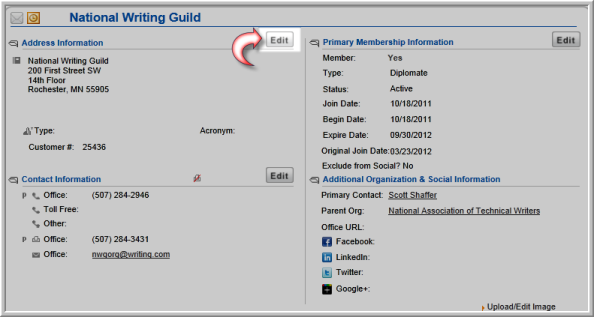

- Go to the Organization Profile.

- Click the Edit button located in the Address Information section of the Organization Profile.

This will open the Organization Information pop-up window.

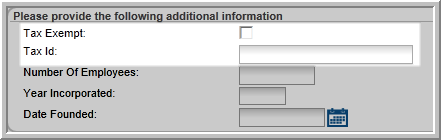

- Scroll to the bottom of the bottom of the Organization Information form to enter the requested demographic information.

- Click the Tax Exempt check box.

- Enter the Tax ID.

- Click the Save button.

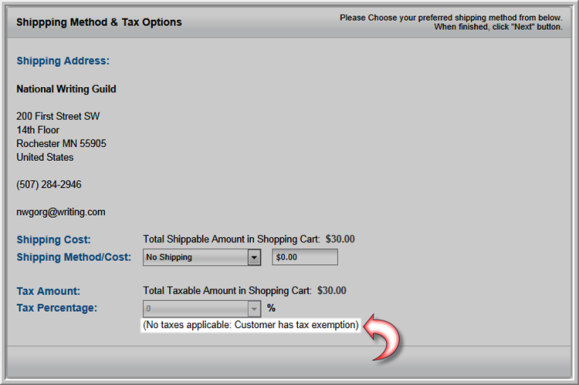

When a tax exempt customer purchases a product that would normally have tax, the Tax Percentage field will be blank and the message No taxes applicable: Customer has tax exemption will display on the Shipping Method & Tax Options page.

The tax exemption statement also displays on the Order Details and the Shipping Confirmation pages.